The question that arises in investors’ minds when the stock markets are at all time high is that – “Is the market overvalued? Should I sell now and buy later when the market drops?”

When investing, it is vital to base our decisions on long-term goals rather than short-term market movements. If the markets are making new highs, it does not always indicate that the market has peaked and a downturn is approaching. Rather, the simple and important lesson to remember here is that “no one can foresee the market direction”. So, investors should stick to the basics, especially at the time of market highs.

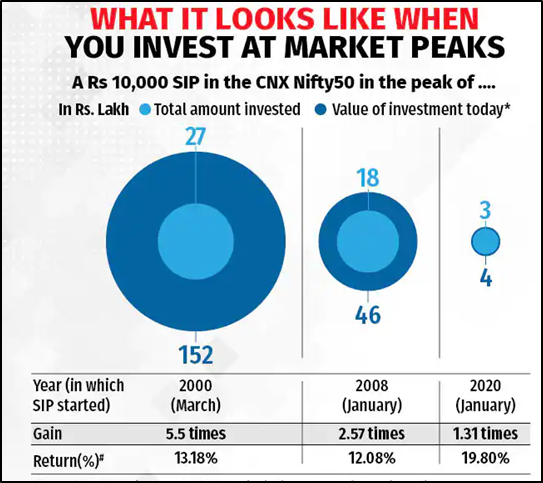

In this blog-article, we will also look at how investing even at the market peaks during the dotcom bubble in 2000 and during the global market highs in 2007 have produced good returns, provided you had stayed invested.

Fear of All-time Highs in the market:

One of the greatest methods to address investors’ fear of an all-time high is to determine how reasonable this concern is and whether the markets will tumble following every gain. Let’s examine at how markets have behaved in the past to get some insight on this subject.

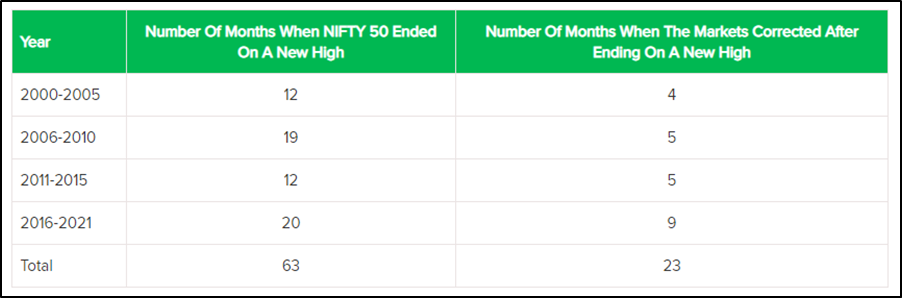

Since January 2000, the NIFTY 50 index has ended each month on a new high 63 times. But the markets have fallen only 23 times following a new high. In other words, the stock market has risen for 40 months in a row, clocking new highs following new highs, which is at a hit ratio of 64% of the time since 2000.

(Source: ET Money)

We can try to figure out from this that equities markets do not always experience a downturn following a new peak. Even rising equities markets may present adequate opportunity for rewards. So, it is not a good idea to skip the rally and abandon the market simply because the stock market has reached a new high or an all-time high.

Even if you only invest at all-time highs, your odds of generating a solid return are relatively high. If you only invested at all-time high levels and stayed invested for at least 5 years throughout in the last 20 years, you would have received positive returns 100% of the time.

More crucially, approximately 7 out of 10 times, you might well have generated more than 8% CAGR returns and hence would have outperformed inflation. We also need to keep in mind that these are merely all-time highs. So you would have easily made double-digit profits if you had invested consistently throughout.

(Source: ET Money)

These statistical data merely demonstrate that, while the stock market may appear to be higher in the near term, you never know when the market rise may finish. Hence redeeming a portion or all of your equity holdings simply because the stock market is reaching new highs is not a smart decision.

However, this does not indicate that you should do nothing after a market surge. When the market is at an all-time high or has corrected dramatically, the four actions outlined below will assist investors in earning solid returns regardless of market highs or lows.

1. Review and Rebalance your portfolio:

When the markets reach all-time highs, you should make some modifications to your investment portfolio. However, these modifications should be consistent with your asset allocation. This is due to the fact that your asset allocation mix will vary when markets move up or down, and you will need to return it to its previous composition. This is known as rebalancing. Rebalancing is a method of investing that requires discipline. Following a sharp market drop, you will increase your equity holdings, and following a market rise, you will sell your equity. That is, you need to rebalance your asset allocation if the variances from your planned allocations are large enough. For example, if your portfolio mix is 75% stock and 25% debt, and the market achieves new highs, your equity allocation would have climbed over 75% while your debt instruments allocation would have decreased below 25%. In this case, you should sell assets in equities (which have performed better) and acquire an under-represented debt class.

Regardless of market highs or lows, investors should bear in mind that if they are getting closer to their financial goals, it is time to book profits in equities and shift the funds into fixed deposits or high-quality debt products. This is due to the fact that stocks are more volatile than debt instruments such as FDs, and by booking profits in equities, you will keep your funds in safer channels as you near your financial objectives. To illustrate this, suppose you started a Rs. 6,000 per month systematic investment plan in an equity mutual fund on April 1, 2018 to support your future car purchase. Assume your goal was to purchase a car for Rs. 5.5 lakh in April 2023 (you may argue that what kind of a car will I get at 5.5 lakhs. Fair enough question, but this is just an example to make you understand the rebalancing your investment portfolio while nearing your financial goals). You would have invested Rs. 3.4 lakh by the end of November 2022, and the worth of your investment would have increased to Rs. 4.95 lakh. Now (in Nov’2022) that you are nearing your target amount of Rs. 5.5 lakh and your target completion date of April-2023, it makes more sense to book profits from stocks and place the funds in safer channels (such as FDs or high-quality short-term debt instruments), so that your produced returns do not erode as a result of equity price fluctuations.

Instead of impulsively buying or selling in the market, you should analyze and adjust your portfolio as mentioned above. Check to see if you are on pace to meet your financial objectives.

2. Continue your SIP and stay invested:

As we’ve discussed thus far in this blog, you should keep investing regardless of market conditions, and that’s exactly what SIPs are for. We shall see two previous market peaks – the ‘Information Technology run’ in 2000 and the ‘Global bull market surge’ in 2007. Assume you invested in the Nifty 50 index to keep things simple.

If you started buying Monthly SIP in Nifty in March 2000 (the month it reached its peak value at the time), and stayed through the downturn until it reached the same top again in December 2003, which is 45 months later, you would already have earned 1.4 times your investment, or a 20% return. This return is known as XIRR, or Extended Internal Rate of Return. (What exactly is XIRR? – Extended internal rate of return (XIRR) is a return metric used when several investments and redemptions (at various points in time) are done in a financial asset. XIRR is the single rate of return that, when applied to each instalment (and any redemptions), yields the present value of the complete investment. It represents the true return on investment. XIRR is commonly used to evaluate returns on investments where several transactions occur at various periods, such as the SIP investments.

Because there are several investments (and hence various purchase prices) in SIP and varied time periods for each instalment, calculating returns is a bit more difficult. Hence, returns on SIP are usually expressed in terms of XIRR.

Returning to our original topic of discussion, if you had begun investing at the market peak in January 2008 and stayed invested through the downturn until October 2010, when the market hit the same position again, your investment would have increased 1.4 times and your XIRR would have been approximately 25%.

(Source: MoneyControl)

Every downturn from the top will be unique, as will the time it takes for the market to rebound. Your SIP return throughout the period is determined not only by the length of time you remain invested, but also by how much the market tries to correct and how long it stays corrected. There is constantly the chance of a correction while markets are rising. However, this should not be used as an excuse to halt your investments.

3. Diversify your portfolio:

We’ve all heard that diversifying our portfolio is important in the investing world. This will be true even when the market is at its peak. Diversification of various asset classes is also important and within the asset classes, diversification is crucial as well. It is possible that your equity portfolio consists solely of small-cap or mid-cap stocks. So, regardless of market changes, a concentrated stock portfolio has a significant risk of losing capital. Diversifying involves including equities in your portfolio with varying market capitalizations. Large-cap companies, for example, might be included in your portfolio because they tend to be steady amid market turbulence. You should also examine your risk tolerance when choosing securities with varying market capitalizations and invest appropriately.

4. Never invest in something that you don’t understand:

One error you should avoid when investing your hard-earned money is ‘investing in a complex financial instrument’. Market mood is such that when the market achieves new highs, it is frequently accompanied by fund houses announcing innovative offers. During market highs, you may encounter a large number of New Fund Offers (NFO). These options might seem to provide excellent profits. However, don’t be misled by these tempting deals, especially if the product is not clear to you. Before you invest your money, be sure you understand what you’re getting into. Furthermore, invest in a financial instrument or product with a minimum 5- to 10-year investing history. Even if you are willing to face the investment risk in a brand new complex financial product, do not put all of your money into a single stock, mutual fund, or asset class.

Conclusion:

The concluding thoughts that we can arrive through this blog-post is that – stopping your investments while the markets are high might be detrimental since equity profits are not determined only by the stock prices of the underlying firms. It is also dependent on how long you remain invested in the stock market.

Furthermore, timing the market is always difficult. The Nifty is now trading around 22,578 points (as on Apr 8th, 2024). In comparison to this, the high made by Nifty in the year 2000 was about 1712. It’s almost a 13-fold increase. This demonstrates that long-term investment is not a fiction. Thus, selling your equity holdings simply because the markets have reached new highs is a bad idea.