Prior to the emergence of credit cards in the mid-twentieth century, saving was more than simply a good habit; it was a must. You would have nothing to fall back on if you didn’t save for a rainy day. But nowadays, only a small percentage of the population saves enough money to keep a fair degree of financial stability. Credit in current times may be a double-edged sword. It boosts our economy and raises living standards. However, people on the other hand, bear the repercussions of overdependence on debt.

Saving money is a crucial element of your overall financial wellness. Adopting good habits can make conserving money much simpler. A few little modifications may be all that is required to ensure a financially prosperous future. We also need to keep in mind that saving as a whole is a time-consuming activity that might take years to yield spectacular benefits. However, with time and care, your saving habits may have a significant impact on your overall financial accomplishments.

So in this blog-post, I have tried to put forth some of the habits that successful ‘Savers’ follow to build long term wealth.

Savers pay themselves first:

Our intuition might take us in the wrong way. Once we get our salary, many of us feel obligated to pay all of our debts before we can save. It feels good to be free of the mental load of bills and other financial commitments such as rent, EMI, groceries, utility bills, etc. However, there is rarely little left over at the end of the month to save. Start “paying yourself first” by diverting a specified percentage of amount on each salary day to your savings account to build up your savings on a continuous basis and form a habit of doing so. Handle this account separately from your regular expenses account, so that you do not touch this account for your normal day-to-day expenses. Make a progress and make it a habit to save a portion of every rupee you earn or receive (that is, not only save from your salary, but also save from any other income that you may receive).

Savers keep a check on their spending:

Saving money is simpler when you spend less. First, try to examine your expenditures over the previous month to see if it was all wisely spent. If it wasn’t, keep a close eye on your expenditures next month. Consider how much you are spending. Always go shopping with a shopping list. We’ve all gone to a supermarket for a handful of minor items and returned with significantly more items. Make a list of everything you require and try to strictly adhere to it. To minimize impulsive spending, buy for groceries at your local store rather than a major supermarket.

Long-term investments in equity mutual funds may be expected to provide an annual return of 10%. So, if you invest Rs. 100 now, it will be worth almost Rs. 750 in 20 years. Going by the similar story, paying Rs. 100 when you were 20 will cost you roughly Rs. 8,850 when you are 65. You may feel these numbers are boring, but still, the crux here is to spend less.

Savers live on a Budget:

Savers are deliberate in how they spend, save, and invest their money, and they employ a well-budgeted spending plan each month to see where their money goes. They do not consider budgets to be restricting, but rather utilize them to develop wealth. Furthermore, they place their monthly savings contribution at the front of their budget rather than the bottom. Maintain your initial spending plans by postponing any impulsive purchase. Review your budgeting achievements and mistakes at the conclusion of each month. Consider the behaviors and events that aided or hampered your budget. Then, for the following month, adjust your budget accordingly. For instance, if you expended more on dining than you anticipated in a month, you should either compensate that expense from other areas of expenses, or you should reconsider your eating out routines.

Savers avoid debt:

Attempting to save when in debt is like swimming against a strong river current. You may never reach your destination if the river speed is faster than your swimming speed. Similarly, any financial goal might be hampered by consumer debt. You simply should not afford any consumer debt (such as credit card debt, personal loan, etc.) if you are unable to pay for any expense in cash. Avoid incurring any excessive debt unless it is for something really critical that must be paid for soon in an emergency circumstance. For these kind of emergency scenarios, Savers build emergency corpus, which is generally 3 to 6 months of their expenses.

Savers have goals:

Saving is simpler when you know why you’re doing it. People, who establish objectives for a buy, whether it’s a car, a television, or a family trip, are more likely to cut back on needless spending in order to achieve that objective. While some customers use credit cards to buy products they cannot pay, successful savers almost never spend money they do not have. When you decide to make a large purchase, check through your budget to determine where you may cut to commit extra bucks to that goal of yours. You may also increase your income and attain your savings objectives faster by taking on a side hustle or another gig that utilizes your marketable abilities.

Savers have Effective tax Planning:

Successful savers understand that their income is simply one of the vital means to accumulate wealth. So, they use well-informed tax planning throughout the year to guarantee that they retain more of their earnings. They employ discounts, credits, and income splits to promote growth while minimizing tax costs to the greatest extent possible. They invest in instruments that benefit from capital gains, dividend income, and even fetch them with tax-free income over other fully taxable assets.

Savers take regular measurements:

Most savers are well aware of how much cash is in their accounts, as well as how much they have saved and expended. They keep track of their earnings and spending. Savvy savers also understand that during periods of income growth, they should avoid lifestyle expenses and instead invest their savings. This might include increasing retirement savings or redirecting the difference to a savings account or to another financial objective.

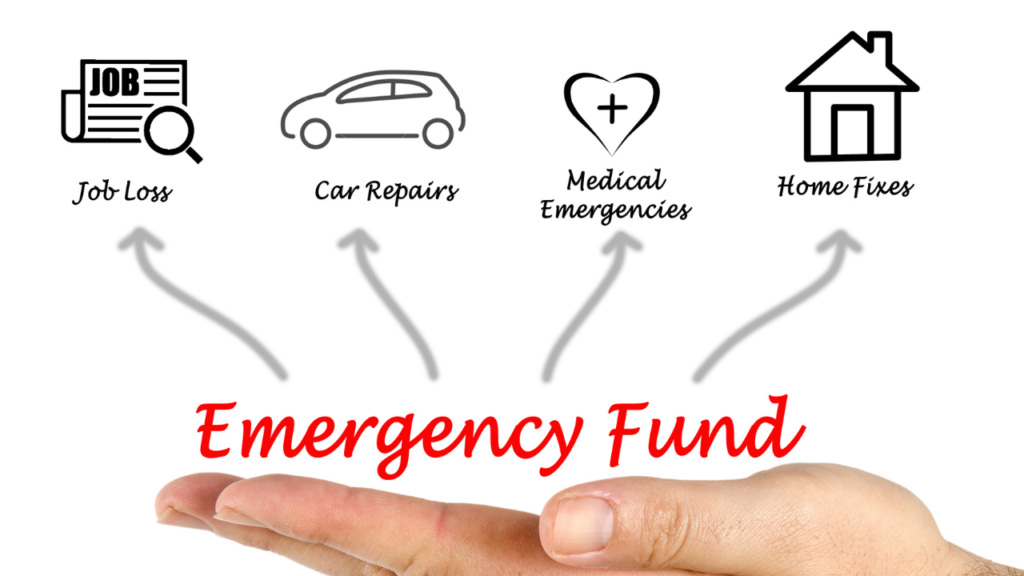

Savers have a Contingency Fund:

Successful savers recognize that their most valuable asset is their income and the flexibility to spend on their own behalf. Crises are entirely uncertain, and they are virtually always financially and emotionally upsetting. Hence as said above, successful savers typically have a fully loaded emergency fund to deal with unanticipated costs that come through no mistake of their own.

We may have sense of calm knowing that if an emergency comes, we are prepared to deal with those emergency expenses if we have at least 6 months of basic living costs stacked up. We don’t need to overcomplicate in thinking how we could invest this money in another way to get greater returns, and we should be ok putting it in a normal savings account, so that we could retrieve it easily during the times of emergency.

Savers are financially responsible in general:

Prudent savers make on-time payments on their bills. They are aware of the their prospective bills that may come their way. They take charge of all elements of their financial lives. Spending less than you earn is critical to financial survival, but many of us rely on credit cards to pay our lifestyle choices. Successful savers understand this and typically live a modest or financially responsible lifestyle, despite having a salary that allows them to enjoy a few frills. Maintaining a modest lifestyle while your income grows can allow you to attain your financial objectives sooner, and hence sooner Financial Freedom.

To conclude, saving enough money to insure your future and retirement is achievable. Good saving habits might put you in a situation to retire on your terms, or even ahead of schedule. Our behaviors determine the course of our life. So we must develop behaviors to promote our financial health. By simplifying the savings habit into its essential components, anybody can adopt the aforementioned habits one by one until they add up to significant positive changes in your financial condition. With a few modest modifications, you may keep increasing your savings over time, thereby building wealth.