Investing money is a smart way to secure your financial future and achieve long-term goals. It not only helps in growing wealth but also in beating inflation, ensuring your hard-earned savings don’t lose value over time.

Saving for your future, for your older age is one of the main reasons why you should invest. Since one day you will either be unwilling or unable to work, investing allows you to have a pool of resources or funds you can draw upon in old age.

Growing our money is crucial for a number of reasons. In this blog article, let’s look at two of the prime reasons for investing.

What is the back story for investing money?

Retirement as an idea didn’t come into existence until the late 19th century. Most individuals used to work till the day they passed away. No period of leisure or no concept of retirement whatsoever.

But, Otto von Bismarck, the German chancellor, reversed that in 1889 by creating the first public retirement plan in history. Those who turned 70 at the time started to qualify for government assistance.

While Germany’s retirement age was initially established at 70, most individuals did not benefit from it because the average life expectancy was substantially lower than 70 at the time. As a result, in 1916, the retirement age was decreased to 65.

This ground-breaking concept of Bismarck later served as the model for state-sponsored retirement plans across the world. And this idea of pension did take off well all across the world due to the fact that people started to live longer.

In 1851, only approximately 25% of persons in England lived to the age of 70. The percentage rose to 40% by 1891, and now, more than 90% of individuals live over the age of 70. Throughout the same time period, similar increases were observed in the United States and other developed nations. Retirement as a concept originated as a result of the significant increase in lifespans across the world. And as retirement became more popular, so did the need to invest and protect wealth.

Reasons to invest:

Even if we now have a justification for investing, this is not the only one. The impact of inflation is the other significant factor.

Hence, these two strong reasons why you should invest are explained in further detail below:

1. To save for your older self:

One of the key justifications for investing money is to save for your elder self, as we just explained. Due to the fact that you will eventually be unable to work in your old age, investing enables you to build a reserve of money or resources for your later years.

Research has proven that considering your older self is one of the best methods to enhance your investing habit, regardless of how different it may be from your present self. For instance, in one experiment, participants were shown “age-progressed representations” of themselves that had been artificially aged to determine whether this had any effect on how they apportioned money for retirement. People who viewed older images of oneself earmarked on average 2% more of their income to retirement than those who did not. This study shows that seeing an older, more realistic version of you may be beneficial in encouraging long-term investment pattern.

In addition, few other studies that looked at the factors that had the most influence on saving behaviour discovered that, aside from emergency savings, those who listed retirement as a savings motive consistently saved more than people who didn’t.

This indicates that other financial objectives, such as saving for your kids’ education, a vacation, or a home, were not linked to better saving behaviours. Saving for retirement, on the other hand, was.

One of the main factors affecting the savings rate is income. But, even when we compare income motivation with retirement motive, people who use retirement as a savings goal are more likely to save on a regular basis than those who do not.

Hence, if you want to save and invest more money, think about your future self. However, the primary argument for investing money is not only your future self. You should also invest due to the financial factors that are constantly pushing against you.

This takes us to the second crucial rationale for investing: which is ‘Inflation’.

2. To preserve your accumulated corpus against inflation:

In social media posts, there is a running joke that reads, “People are growing stronger. Twenty years ago, carrying 200 rupees’ worth of groceries required two persons. But today, a five-year-old can carry it.

Sadly, this comedy is not about the youth’s growing strength but rather about the rupee’s diminishing worth as a result of inflation. This joke demonstrates how inflation—the overall rise in prices over time—is an inescapable fact of life.

Inflation may be compared to an unseen tax that all owners of a certain currency must pay. The holders incur this tax continuously without even being aware of it. Their grocery expenditure gradually increases. The expense of repairing their home and vehicles, as well as the price of their child’s education, rises yearly. Has their compensation grown in the interim to cover these rising expenses? This is important question that has to be pondered upon by individuals while combating the inflation.

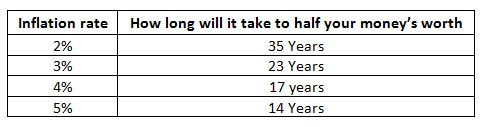

Inflation remains a thorn in both scenarios. And while the consequences of inflation are typically negligible in the near term, they can become rather important over longer time frames. Let’s look at the graph below to discover how long it takes for inflation to reduce your money’s worth by half:

As seen in the graph, with 2% yearly inflation, a currency’s buying power will be slashed in half within 35 years. At a 5% yearly inflation rate, buying power is cut in half every 14 years. The current inflation rate in the Indian economy is at 6%.

This suggests that at moderate levels of inflation, the cost of basic items will double every two to three decades and much more rapidly if the inflation rate is higher.

Following the conclusion of World War One, Germany’s Weimar Republic provided a more egregious case of inflation (hyperinflation). When inflation was very rampant, prices would frequently fluctuate during the day. There were tales back then of restaurant lunches costing more when the bills arrived than when the food was ordered. Although these types of circumstances are uncommon, they serve as an extreme example of how detrimental inflation can be.

Yet, there is a powerful defence strategy, and it is referred to as “investment”. You may successfully combat the consequences of inflation by owning assets that maintain or increase their buying power over time.

For illustration, to keep up with the rate of inflation from 1926 to 2021, $1 would have required to increase to $15. Hence, in order to stay up at this time, you should have unquestionably made an investment in bonds or equities.

According to an example provided by Adam Fergusson in his book “When money dies,” if you had invested $1 in long-term US Treasury bonds in 1926, that amount would have increased to $200 (13 times more than inflation) by 2021. Yet during the same period, $1 would have increased to $10,937 (729 times larger than inflation) if you had placed it in a diverse portfolio of American equities, such as an equity index in 1926.

This exemplifies how investing money may help you build and keep your money by reducing the effects of inflation. In particular, pensioners will be compelled to pay higher costs without the advantage of rising income. Asset appreciation is the only shield against inflation that retirees have, because they don’t go to a job.

Thus, while there are some legitimate reasons to store cash (emergencies, short-term savings, etc.), holding cash in the long run is virtually always a negative bet due to the yearly toll of inflation. Hence, invest your non-emergency money if you wish to lessen the effect of this inflation burden.

Conclusion:

To build wealth, beat inflation, and save for retirement and other financial goals, investing money is essential. You don’t need a large sum to begin—small amounts can grow quickly through the power of compounding.

Investing money is the most effective way to make your finances work for you. While bank savings accounts are considered safe, investing allows your funds to grow in value, protect against inflation, and create long-term wealth. Start investing today to secure your financial future.

You can check out on two more articles, one on how to easily save each month, and other on how to tame the inflation easily.

You can also follow me on Quora, where I post several contents on Personal Finance, investments, money management, etc.