It is crucial to create a well-balanced financial plan to fund higher education costs. In this blog, we will discuss how to build a child education investment strategy. The cost of quality education has surged over the past decade, making it essential to start planning early. While tuition fees have reached an all-time high, a small relief is that they are often paid in manageable chunks, aligning with monthly or quarterly expenses. While saving for school education is important, the bigger financial challenge arises when your child pursues higher education.

Higher education, on the other hand, is a different beast; it necessitates a substantially larger sum over a shorter period of time. For example, an MBA from a renowned B-school in India today costs roughly Rs. 25 lakh, nearly twice what it did a decade ago. High fees are not limited to top institutes. Even a typical private university will want you to pay a significant sum.

The bad news is that the expense of higher education will continue to rise. The same courses would probably cost between Rs. 40 and Rs. 45 lakh in ten years, assuming a 6% inflation rate. In reality, you have no alternative except to invest a percentage of your monthly income. And it goes without saying that this is a financial goal that no parent would want to jeopardize.

Always start with Insurance:

Kids always say “I” for ice-cream. But when it comes to designing their education financial plan, the first requirement is to buy “I” for Insurance. Yes, we need to buy an adequate term insurance plan that would protect the family in case of the sudden demise of the earning member. Insurance should always be the first, and then rest of the surplus of your savings maybe allocated to child education, retirement, wealth creation heads and other financial goals.

Next comes the important question: where and how to invest for our child’s higher education cost?

How much should you invest monthly?

When investing for your child’s higher education, you cannot set a precise goal. It’s difficult to predict the path your child will eventually choose because fees vary based on that as well. Another factor to consider is sending your child overseas.

Yet rather than overthinking these issues, it is crucial to begin saving money. If you fall short later, you can take out a modest education loan to make up the shortfall. That’s a lot better than taking out a hefty, full-fledged educational loan.

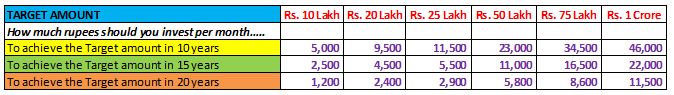

I assume that you will be having the basic idea of the current costs of the higher educations that are prevalent in the market, such as an Engineering, MBA, MS, M.Tech, Medicine, etc. You can just apply 6% inflation rate to those costs to arrive at how much it will cost 10 years from now, 15 years from now and 20 years from now. I have done a hypothetical illustration in the below table. (I have assumed an 11% p.a. returns in the below illustration):

Hence in line with the above table, I have arrived at how much you should invest monthly in order to achieve the higher education costs 10 years from now, 15 years and 20 years.

How to amass such a huge capital?

Despite the fact that the college expenses discussed above will make for a dismal read, there is still hope. Even if you are currently making a little salary, there are established methods for meeting your long-term goals.

Some of the standard evergreen tips that you can follow are:

- Begin investing as soon as possible and as much as you possibly can.

- Exercise caution while investing.

- Try for a somewhat larger corpus. For example, if you believe you will need Rs. 35 lakh for your child’s higher education in 10 years, start investing with a Rs. 40 lakh goal in mind.

- Assume that your investment returns will be poor. Expect 10% returns, rather than an enthusiastic 15%. This would allow you to amass an even bigger corpus.

- With each income increase, increase your SIP commitments (essentially your investments towards this objective).

- Adjust the goal amount based on the child’s abilities. As your kid grows older, you will have a better notion of the field (engineering/science/commerce/management) they intend to pursue. For example, by class 6, you should have a good idea of your child’s ability. After class 10, things will be lot easier since your child will be able to pick what they are interested in studying. And, because college expenses vary by stream, you’d have a better notion of how much money you’d need by then. Therefore, it is critical to revisit the goal amount in light of your child’s changing interests.

Finally, we have come to the biggest question of this blog, “Where to invest” for our child’s higher education cost?

This is one of the most often asked questions, and with good reason: there are so many alternatives on the marketplace today. So, let us go through each choice one by one.

CHILD PLANS OF INSURANCE COMPANIES:

These plans frequently promise a specified amount of maturity value or return. These are often long-term insurance that last 10 to 15 years. On the surface, they appear to be the ideal option because they mix insurance with investing. However, in practise, it does not serve its purpose. These plans provide below-average returns since a portion of your money is allocated to a term insurance policy that may be purchased independently at a considerably cheaper cost.

CHILD-SPECIFIC MUTUAL FUNDS:

Child mutual fund programs are mostly a hybrid model, investing in a mix of stocks and bonds. They usually have a five-year commitment. These plans will not provide additional returns just because they are intended for your child’s higher education. In truth, they don’t provide anything special; they’re just standard mutual funds with the name ‘child’ plastered on them. Alternatively, you can choose any equity-linked mutual fund. They can perform as well as, if not superior, to any child-specific plans.

UNIT-LINKED INSURANCE PLANS (ULIPS):

ULIPs are insurance products which offer exposure to equity as well. However, their disadvantages exceed their advantages, as they are expensive, difficult to comprehend, and come with a five-year lock-in term. If the plan performs poorly, the extended lock-in period may prohibit you from moving to a better choice.

BANK FIXED DEPOSITS:

As we all know, bank fixed deposits (FDs) are an age-old form of safeguarding and investing funds since they are entirely safe and give guaranteed returns based on the length of time you park the funds with the bank. Although an FD can be stopped early, a penalty is imposed on the interest earned. FDs are more suited to investing for short-term purposes. Long-term returns are exceptionally low and frequently fall short of meeting inflation. FDs are also ineffective in terms of taxation. Every fiscal year, the interest generated must be applied to the investor’s taxable earnings and taxed at the corresponding slab rate.

PUBLIC PROVIDENT FUND (PPF):

It’s a tax-free, risk-free investing option that many individuals utilise to save for long-term goals. A PPF account has a 15-year lock-in term, however it can be cancelled prematurely after five years for specific reasons. One such reason is supporting your child’s higher education. PPF interest rate is 7.1% as of the date of publication of this blog. While the PPF outperforms the other three alternatives discussed above, you can surely do more effectively than this, as you’ll see in the section on ‘Equity mutual funds’ (listed below).

EQUITY MUTUAL FUNDS:

This is the undisputed winner of the investment competition. If your child’s college education is more than five years away, putting a substantial percentage of the funds you have in equity is an excellent option. Nothing gives higher long-term returns than equities, which is why it is suggested to invest in equity-oriented mutual funds.

Even though stock is a short-term volatile asset, the risk factor flattens out over time if you stay onto it and continue making systematic investments. Indeed, historical evidence demonstrates that equity has a better return potential. On a 15-year or even 10-year period, at least 75% of equity-oriented funds have exceeded the PPF in terms of post-tax returns. One who has invested Rs. 10,000 each month in an equity fund for the previous ten years would now have a sum of Rs. 25 lakh, as opposed to Rs. 18 lakh in the PPF. That is a variance of almost 7 lakhs.

Equity-based investments, such as an equity mutual fund are certain to perform better than fixed-income assets, such as PPFs or FDs, in the long term. This is why you should invest at least 75-80% of your money in equity funds. It will assist you in saving more money for your child’s future education costs.

Last but not least, how to exit these investments?

It is easy to become stranded with our investments and find ourselves unable to pull out at a suitable time. When investing in stocks, you must definitely have an exit strategy in place. Consider the months of February and March of 2020, when the markets plummeted owing to the COVID outbreak. Between the beginning of 2020 and end of March 2020, the Sensex fell 37%. Consider what would have occurred if your child’s educational objective had been due in early April 2020 or by the end of March. During that period, Rs. 50 lakh amount would have been reduced to Rs. 38 lakhs.

This highlights the need of having a fail-safe approach. The ideal practise is to withdraw from our stock investment gradually, around 12 to 18 months before you need the funds. Initiate a systematic withdrawal strategy (SWP). SWP is the inverse of a SIP in that it allows you to withdraw your investment at predetermined periods.

But as a disclaimer, please note that while SWP is at risk-mitigation strategy, it doesn’t guarantee you reach your target amount. But as mentioned above, investing in equity oriented mutual funds will fetch you far more rewarding returns than the other fixed income products or the several insurance-blended investment products.

Check out my other article on how you can build your Child’s investment journey since their birth.

Do Follow me on Linkedin and Quora for more such insightful posts on investments, personal finance, insurance, money management, etc.

[…] Hence you can kick-start this financial goal by investing this 50k in your hand. You can invest this in Child Plans of Insurance companies, Child specific mutual funds, ULIPS, Mutual funds, etc. I have written a detailed blog article about how to devise an investment portfolio for your child’s higher education costs. You can check that out here. […]