Geopolitical upheavals, such as the current Israel-Gaza conflict or the Russian-Ukraine war, have focused attention on asset diversity, which aids in risk management of your investment portfolios. Historically, Indian investors have frequently limited their portfolios to domestic assets, restricting their diversification options. Accepting global markets can provide a great channel for increased diversification. Investing in international assets has grown in significance, particularly in international fixed income securities. With this more comprehensive strategy, Indian investors might potentially diversify their portfolios more widely and lower their risk.

Given that interest rates are projected to rise for some time, US treasuries are becoming a more appealing alternative to risk assets. The earnings yield, which is effectively the inverse of the P/E ratio, is a useful measure for investors. It provides information on the return on investment in terms of corporate earnings per rupee invested in the market.

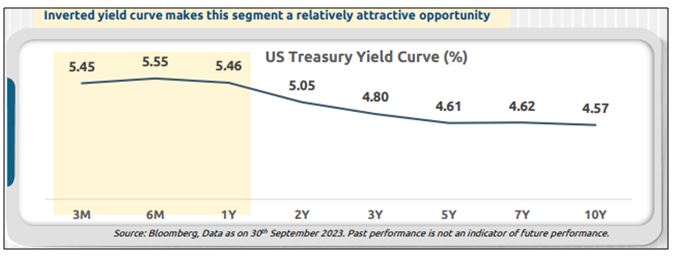

The earnings yield on the Nifty index is 4.5%, while the yield on a one-year US Treasury note is 5.46%. This convergence is an exciting development in which bonds are now posing a significant challenge to equities as an investing option. Investors are presented with a new reality: a plethora of investing choices.

Sovereign guarantee

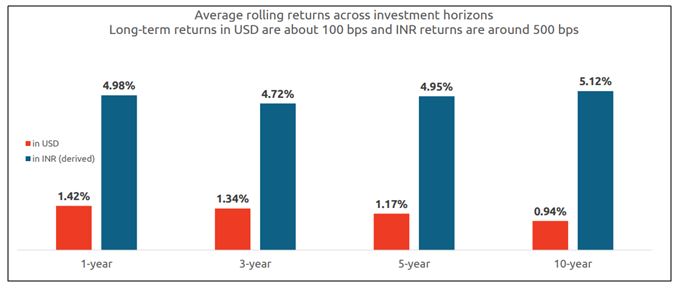

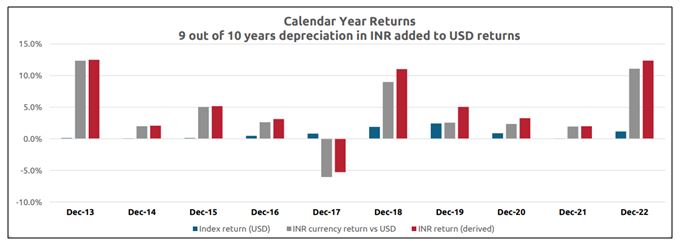

Given the US yield curve inversion (long-term rates are lower than short-term yields, as seen in the US Treasury yield curve), the 0-1-year marketplace offers the greatest yields of 5.45% to 5.55%. In comparison, 10-year US Treasury bonds provide 4.57%. And, assuming the Indian currency depreciates, earnings in rupee terms add another 4-5% to your dollar-denominated gains.

Other advantages of this US sovereign investment include the fact that the US is the world’s largest economy and the world’s most dominant reserve currency. The US government debt, a very high-quality asset, has an AA+ rating from rating agency Standard & Poor’s. As a result, when risk-off sentiment rises, investors prefer US bonds over bonds and stocks from other nations.

Currently, there are two methods to invest in US bonds: one is through Mutual Funds and the other is through Direct Bond ETFs, with a third option – Bond Baskets – in the development.

(1) Mutual Funds:

A Fund of Funds (FOF) is a Mutual Fund that invests in another Mutual Fund or ETF. According to the discussion in this blog post, US bond exposure can be obtained by typically investing in a FOF, which invests in a US exchange-traded fund that has exposure to US treasuries. Except for modest cash assets for liquidity purposes, the FOF will be 100% exposed to US treasuries.

There are FOF’s which invest in US Treasuries with maturities of up to one year, making it low-risk in terms of interest rate risk. These FOF are less sensitive to bond durations, making it excellent for people looking for a USD asset to finance short-term or pre-set near-term costs without risking themselves to equity market fluctuations. The modified duration of these short duration (upto 1 year) FOF’s are merely 0.30. Given the average maturity and duration of 0.3 years, any prospective increase or fall in interest rates is predicted to have little influence on the underlying Fund’s yield. This means that the fund’s net asset value, or NAV, will only be negatively impacted by 0.30% for every 1% increase in interest rates. These funds give investors with a simple way to diversify their exposure to US dollars.

Investing in US government securities with short maturities provides a great blend of high-quality and low-volatility investment options.

The sole drawback to investing in these kind of FOF’s is that, while the Rupee has declined versus the US dollar in 9 of the previous 10 calendar years, any prospective improving/ appreciation of the Rupee might reduce overall profits from these FOF’s.

(2) US Bond ETFs:

International ETFs tracking US Treasuries can also be purchased through domestic brokers with overseas affiliates or foreign brokers with a domestic footprint. Although these platforms provide access to a wide range of bond ETFs, US Treasuries and US agency bonds are of particular importance. The only major drawback is the accompanying costs. Brokerage houses might levy fees ranging from 0.2-1% each trade up to a monetary ceiling in dollar terms. Then you have to pay withdrawal fees every time you make a withdrawal after the sale. Foreign exchange transfer fees and impact fees (bid-ask spread) are also incurred while dealing with these investments.

This investment is also subject to Reserve Bank of India’s Liberalised Remittance Scheme (LRS), which enables Indian nationals to freely remit up to $250,000 for any kind of acceptable foreign currency transaction each financial year. According to the Budget 2023, all such transactions will be subject to 20% Tax Collected at Source (TCS), beginning October 1, 2023 (up from 5% before). This implies that you’ll have to set aside an additional 20% for the same purchase as previously, which will be deducted by the taxing body. Furthermore, even if you are tax-exempt, such overseas assets must be mentioned in your income tax filings, increasing your compliance hassle.

(3) Bond baskets:

A few Indian Fin-Tech firms are planning to provide worldwide custom-created bond baskets that provide diversification in terms of regions and maturities. Primary offerings of overseas bonds will also be included. These products are currently in the development stage.

CAUTION WHILE INVESTING IN THESE:

While fixed income is often regarded as a secure investment, exposing one’s portfolio to overseas markets raises the regulatory burden. Using new brokers might also introduce platform and execution issues. As a result, before investing in these securities, investors must conduct thorough due diligence.

And as a disclaimer, please note that none of the above mentioned is to be taken as an investment advice from my side. These are just to make people aware of the options available to invest in US Bond market. This blog-article is strictly for educational purpose.

US Economy is not gonna fail, at least for the next 100 years.