The Indian government launched NPS Vatsalya, a new program within the National Pension System (NPS), to promote retirement savings.

The NPS Vatsalya program is a big step toward protecting our youngest citizens’ financial future at a time when financial planning is more important than ever. With the help of this program, parents or guardians may begin saving for their children’s retirement from an early age.

This pension plan was created especially for kids under the age of eighteen with the goal of fostering a saving and investing culture at a young age. In addition to giving parents an effective instrument to protect their kids’ financial security, NPS Vatsalaya encourages the next generation to be financially literate by offering an organized plan for long-term wealth creation.

NPS Vatsalya accounts can be created for any child, regardless of gender or age. This account will change to an NPS tier 1 (All Citizens model) account when the child turns 18.

Features of this scheme:

The Pension Fund Regulatory and Development Authority of India (PFRDA) governs and supervises this pension program. Parents can choose to invest a minimum of Rs. 1,000 every year under this plan, with no upper limit.

Investors in this NPS Vatsalya will have access to a range of investment opportunities, just like in NPS for adults. It is also possible to use the auto-choice or active-choice investment options here. Every asset class that is available to adults in NPS will also be available here. The child’s parent or guardian will have the option to invest in government securities, corporate debt, alternative investments, and equity.

Additionally, the parent or guardian has the option to choose from any pension fund that is registered with the PFRDA.

The way the account operates is the primary distinction between NPS Vatsalya and regular NPS. Until the child turns 18, the account will be managed by the parents; after that, it will be transferred into the child’s name. The scheme’s only beneficiary will be the child and only the NPS Tier 1 account is available via NPS Vatsalya.

Parents have two options for opening an NPS Vatsalaya account – 1) they either visit one of the many Points of Presence (POPs), which include major banks, India Post, and Pension Funds, or, 2) for a more convenient alternative, they can utilize the internet platform, e-NPS.

Parents must submit the necessary paperwork while creating the account in order to meet Know Your Customer (KYC) norms.

Long-term compounding effects:

This scheme’s primary benefit is its early start time. You can start saving for the child’s retirement before they turn 18 years of age. The invested corpus will profit from compounding due to the extended investment horizon, which spans from the kid’s childhood to age 70. A scheme like this may also encourage kids to save money.

The majority of children’s programs currently in place have a short lifespan. Usually, they come to an end when the kid reaches a given age or after a set period. Children will now have a long-term retirement tool in the form of this instrument. Prior to the implementation of this scheme, parents handled the Public Provident Fund (PPF) in a similar manner, managing it until a specific age before transferring it to their kids.

As NPS Vatsalya just requires an annual contribution of Rs. 1,000, it is simple to start and maintain.

Low liquidity & Exit Options:

An concern for investors in NPS Vatsalya might be liquidity. Following a three-year lock-in period, up to 25% of contributions may be partially withdrawn, with a maximum of three withdrawals permitted for certain purposes. This tool is very helpful when dealing with important life events like weddings, certain illnesses, school expenditures, etc.

When the child reaches the age of 18, they can leave the scheme. The full amount may be taken out in one single payment if the accumulated corpus is less than Rs. 2.5 lakh. However, only 20% can be taken out as a lump-sum amount if the accumulated corpus equals or exceeds Rs. 2.5 lakh, and hence the remaining 80% must be utilized to buy an annuity plan.

When significant monies are required for marriages or school fees or college fees, receiving an annuity payout of 80% of the corpus may not be beneficial. In contrast, in a mutual fund, any amount can be withdrawn at any moment. Hence this product’s guidelines for partial withdrawal and exit make it limiting for many investors.

The child must continue to participate in the scheme until they retire. Since only 20% may be taken out in one lump-sum payment, there may be a liquidity problem if the child is unable to make contributions to the scheme.

The plan guarantees that the full corpus is given back to the specified beneficiary (either of the parents) in the regrettable event of one of the parent passing away, giving the child financial stability and peace of mind for the future. If both parents pass away, a legally designated guardian may continue to serve until the child becomes 18 years of age (but the guardian need not have to make yearly payments). The entire corpus is given back to the parent/guardian in the unfortunate event of the child passing away.

Investment options:

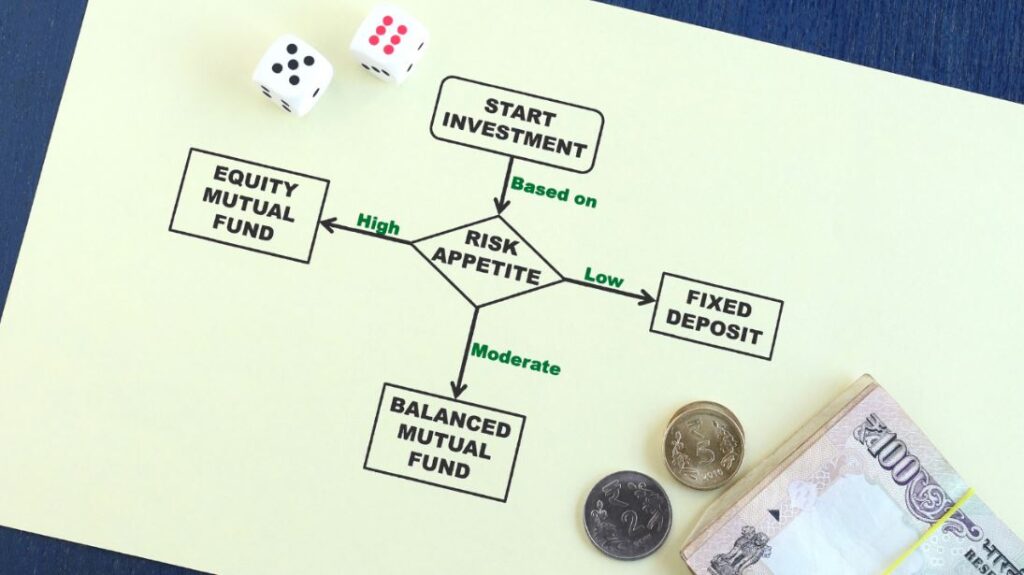

Parents can choose from any pension fund manager who is registered with the PFRDA. There are three alternatives accessible when it comes to investing. The Lifecycle Funds Aggressive, which invests 75% in stock, Moderate, which invests 50% in equity, and Conservative, which invests 25% in equity, are the options available to parents in Auto Choice. A Moderate Life Cycle Fund (LC-50), is the default option.

Parents can take a greater involvement in Active Choice by choosing how their money is distributed among different asset classes, such as up to 75% stock, up to 100% corporate debt, up to 100% government securities, and up to 5% alternative assets.

Who should opt for NPS Vatsalya:

The scheme is appropriate for parents who want to ensure their child’s financial stability. NPS Vatsalya may be a good choice for anyone looking for a long-term investment option with the possibility of greater returns. It could appeal to those looking for flexibility in their asset mix and investing style (auto and active choice). But it should be avoided by people who want liquidity. Those seeking 100% equity exposure can refrain from this scheme, as the maximum permissible equity exposure is 75%. Also, their equity schemes are generally large-cap oriented. Another drawback is the difficulty in building a portfolio that is skewed toward small- and mid-cap firms, which have the potential to provide alluring long-term returns.

Parents may also steer clear of the plan if they are unsure if their child will participate when they assume charge of this scheme at a later stage.

Final words:

NPS Vatsalya seeks to give young people a strong financial foundation by promoting early investing and offering a structured savings plan. This creative scheme not only guarantees that children will profit from consistent saving and compounding over time, but it also instils a feeling of financial responsibility in them at a young age.

Having said this, parents should choose priorities carefully now that there is a tool to save for a child’s retirement. Their own retirement should be their first priority, followed by their children’s higher studies, marriage and finally those children’s retirement. Most importantly, people should not jeopardize their own retirement funds for the sake of other priorities.

Also, when choosing the asset mix in this scheme, parents should also take their risk tolerance into account. Even if equities have traditionally produced the highest returns, we shouldn’t choose to have maximum equity exposure. When it comes to investing, we also need to take our risk tolerance into account.

In addition to this scheme, parents should invest in more liquid assets like mutual funds for your child’s future goals. Keep in mind that you will not be able to access the whole corpus in this account.