Imagine you’re planning a trip to a foreign museum. Not only an entry ticket to the museum is enough, you would also prefer a Guide, who has good knowledge and experience in explaining the different spots in a museum and the history behind the showcased products in a museum.

In the same way, choosing the appropriate fund manager for your financial path is just as crucial as choosing the best mutual fund. After all, simply having a license does not qualify someone as an excellent driver, or, in our case, the finest fund manager.

In this blog post, we will look at a few crucial aspects that will assist you pick the best fund manager.

Select the “ideal” manager who suits you, not the “best” manager in the industry:

Instead of pursuing the most well-known or well-liked professional, you should seek for a fund manager who will assist you in matching your investments with your financial objectives.

For instance, imagine enrolling yourself in a wellness conference, anticipating unwinding with the practice of yoga. But you find out after enrolling that the instructor’s definition of wellbeing includes trekking, cycling, and mountain climbs. Even if the trainer is well-known to you, their schedule might not work for you.

In the same way, take into account the fund manager’s investing approach and expertise. For investors who are cautious with a limited risk tolerance, a particular fund manager’s bold and oversized investments may be too much to handle. On the other hand, a cautious manager’s strategy could not please a more ambitious investor.

In either scenario, there is a significant chance of us quitting a mutual fund before it achieves its maximum potential, which widens the discrepancy between investor’s actual returns and the investment’s actual returns. If the fund’s way of operating doesn’t align with your investment tastes, you can lose money even if the fund does well.

Do not compare a fund manager’s previous fund’s performance with the current one:

In team sports like Cricket, the captain frequently receives the credit for winning, although each player’s abilities, the facilities for training, the coaching philosophy, and other elements all play a part in success. Hardik Pandya was the captain of Gujarat Titans for 2 seasons and during his short stint, he won one title once and was runner-up the other time. But when he came to Mumbai Indians as a captain, he was booed by everyone for his captaincy.

In the same manner, a fund manager’s effectiveness is influenced by his team of analysts, the fund house’s values, risk control, and available resources.

Additionally, it might be deceptive to depend on a fund manager’s prior success when they change employment. History demonstrates that even top-performing managers occasionally find it difficult to duplicate their achievements when joining a new company.

Assessing the fund manager’s performance with the present fund is therefore essential. Although their career track-record is shown by their historical success across other funds, their unique decisions with the present fund provide more information to help you make an informed investment selection. This could be easier said than done, though. As of now, it can be seen that the majority of fund managers have a somewhat mediocre track record with the funds they now oversee.

It may be a little challenging, but looking at the numerous funds handled by a fund manager throughout cycles, accessing communications from the fund manager, and layering the decision with an ample amount of qualitative opinion may be beneficial.

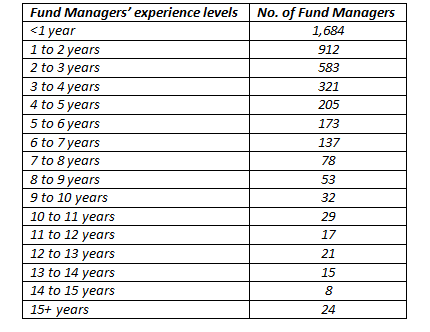

As we can see from the table below, there are 1,684 cases where fund managers have been involved with a particular fund for less than a year; the number sharply declines after five years. This indicates that the number of years that fund managers have worked with a certain fund is comparatively not much.

We may argue that the mutual fund industry as a whole itself has been prospering in the past 20 to 25 years in India. That is true, but still the data from above table shows that the track record of fund managers in India is limited for us to do an extensive individuality analysis on their past fund management experiences.

Don’t rely on past performance:

Without clear background information, previous performance might be deceptive. However, we have the constant temptation to use it as the main source of fund assessment metrics.

Strong performance during an overall market rise, for example, could not be a reflection of the fund manager’s aptitude or judgment. In the same way, the performance of a portfolio that a new manager may have taken over could be attributed to them. The capability of a fund manager to effectively handle market downturns and various market cycles is an actual measure of their knowledge and competence.

It’s also critical to comprehend the elements that influenced his or her achievement and determine whether they meet your own standards.

Crisis Management is the key:

Investors should seek managers with great fund management skills since the context of our comparison differentiates talent from luck.

The capacity of fund managers to handle crises is a real litmus test for their expertise and judgment. In favourable circumstances, it’s quite simple to be recognized, but in difficult times, the talented manager is separated from the luckiest.

In addition to capturing the positive aspects, a fund manager’s job is to guard against negative risks, particularly during periods of volatility. It would be a significant indication of their expertise if they had a track record of demonstrating certainty in their judgments, responsiveness in implementation, and a dedication to providing value during difficult times.

Final words:

The process of selecting the best fund manager may appear difficult, but it becomes much easier for investors when they establish specific standards, such as those covered in this blog above.

The stock market fluctuates between bullish and negative periods, and different fund management approaches correspond with these cycles. Selecting the best fund manager and a strong mix of fund management techniques will guarantee that an investor’s corpus can yield the highest returns possible given the circumstances.

Finding the ideal fund manager entails going beyond the manager’s credentials and instead concentrating on identifying an individual whose investing philosophy complements your financial objectives, assesses performance in a context-appropriate manner, and exhibits fortitude during difficult circumstances. Keep in mind that even during difficult times, the correct manager can guide your financial journey smoothly. For an individual wishing to invest in mutual funds, this choice is so crucial.