The book “7 Secrets to Investing Like Warren Buffett”, was written by Mary Buffett and Sean Seah, and was published in 2019. This book provides a helpful summary of the most basic guidelines for investing like an expert. A lot of the advice it offers goes into the fundamentals of value investing. This has long been Warren Buffett’s preferred strategy for choosing which companies to invest in.

Learn how to invest like the best person himself:

When it comes to investment, Warren Buffett is one of the few people who has achieved widespread recognition. He attained that position by making his initial investments in the 1950s and building early triumphs into a portfolio worth billions of dollars. Being among the richest persons in the world, it is understandable why people frequently seek Buffett’s guidance and investing tips.

This book’s writers have outlined the seven key elements of building a successful, long-lasting stock portfolio. Inspired by this book, we will talk about these seven secrets of investing in this blog article.

Secret No. 1 – Saving money and avoiding debt are key to creating wealth:

To invest, you need money. Therefore, we have to deal with setting aside the money you will need before we even begin to choose the appropriate stocks. Despite the fact that not everyone is inherently good at saving, it’s one of the most essential elements of success. For this reason, you should develop the habit of saving it regularly and persistently.

Hence, saving 10% of your income is the first step. Put this money in a different savings account, which is not easily reachable by you to take money out of it easily. The urge to dip into this pot is something you should try to avoid. After setting up your savings account, begin transferring 10% of your earnings or income to it. Consistently add to it with each and every paycheck or income you get.

One of the most effective ways to develop a beneficial habit is to start small and increase your commitment over time. It all comes down to maintaining consistency and manageability. Many people set too ambitious objectives at the beginning, only to falter and fail a short time later.

The next question that comes in our mind is: What is the ideal amount to save? A reasonable rule of thumb is to have a sizable emergency fund, maybe six months’ worth of spending, which will cover your expenses for a while in the event that your income is abruptly stopped for any reason.

Additionally, it makes sensible to get an insurance policy, such as a disability and accident plan. The plan should cover at least 10 times your present salary.

People who win the lottery and become instant billionaires waste their money because of this reason that they have not formed the habits necessary to maintain their fortune.

Secret No. 2 – The principle of value investing:

There are investors who only speculate. However, some, such as Warren Buffett, have a process. They follow well-defined procedures to ascertain two things. The first is the actual worth of a company, and the second is whether the stock price of a company is in line with that worth. Value investing is all about this.

Naturally, Warren Buffett is the type of investor who understands a company’s worth very well. In fact, one of his mentors, Benjamin Graham, taught him the fundamentals of value investing. In the early 1950s, Buffett learnt value investing from Graham, who taught it for many years at Columbia Business School.

We now have all the necessary knowledge at our fingertips and the world has greatly improved since the 1950s. You may identify discounted or undervalued stocks by researching the market and examining key data and reports. This essentially implies that you can find companies whose worth exceeds the price at which their stock is sold.

Undoubtedly, when it comes to the stock market, there is no such thing as a written promise. However, a great deal of research has been done on value investing. It demonstrates the effectiveness of investing in undervalued businesses. It’s definitely better than making assumptions or following your own instincts about the market.

After you invest, it’s possible that an already discounted company may become much more undervalued after you had invested in it. You might have to pay for this. This is when “patience,” another of Buffett’s tactics, enters the picture. The company’s actual worth will almost certainly be discovered, and you will then receive a handsome return on your investment.

Secret No. 3 – Use your own interests to find investment ideas:

Warren Buffett is well known for not making investments in companies he doesn’t understand. For this reason, he tries to avoid businesses that deal with technology and the internet. Rather, he makes investments in companies like American Express, banks, and airlines, as well as brands like Kraft Foods and Coca-Cola. Buffett is knowledgeable about the businesses he invests in. This indicates that he is aware of their offerings, their business practices, and the worth of their products or services.

Buffett has referred to the “circle of competence” as the ideal region where his investments and passions converge. By asking some simple, rational questions about your interests and how you define success in business, you may determine your own circle of competence.

Make a list of all the companies or brands you are familiar with, such as the business or industry you work for and are aware of its offerings, the products or services you regularly use, the brands or products you spend your money on, the companies or products that you see are gaining more clients and expanding their consumer base, etc.

By writing down these names, you should be able to discover some company categories or industries that are within your area of expertise. You can start your search for businesses to invest in from this list.

Secret No. 4 – Look for companies with economic moats:

Buffett did more than simply finding undervalued businesses in accordance with value investing concepts. He also searched for stocks that included a loss buffer. When looking for profitable investments, you could additionally keep an eye out for this.

Certain companies provide a service or product that can withstand all the ebbs and flows and shifting cultural trends. The term “economic moat” refers to this type of safety net that a company possesses.

Here, the author provides a few instances. Take for example, Coca-Cola. This brand has survived both world wars and depressions. It remains popular with successive generations. Others, such as Pampers, are now so normal that people use the brand name for the actual product. We’ll say, “I’m going out to get Pampers,” rather than, “I’m going out to get diapers.” So, Pampers and Coca-Cola are two businesses that have an economic moat.

The most important thing to keep an eye on is if a product may command a greater price and still attract buyers. These are the businesses that are most likely to remain at the top for a very long period of time.

Maintaining an economy of scale is another indication of an economic moat. It is frequently linked to a low-cost, effective manufacturing approach. Businesses that have created it are able to beat down rivals by charging cheaper rates. Amazon is arguably the finest illustration of this in the modern era. Amazon frequently offers low prices that are just unbeatable at other online retailers or even in offline stores. The economies of scale that Amazon has developed for itself over time are largely responsible for this.

Economic moats, however, might not endure indefinitely. Therefore, we should determine if the company’s product or service depends too much on inventiveness to be viable.

Secret No. 5 – Learn to read the financial statements of a business:

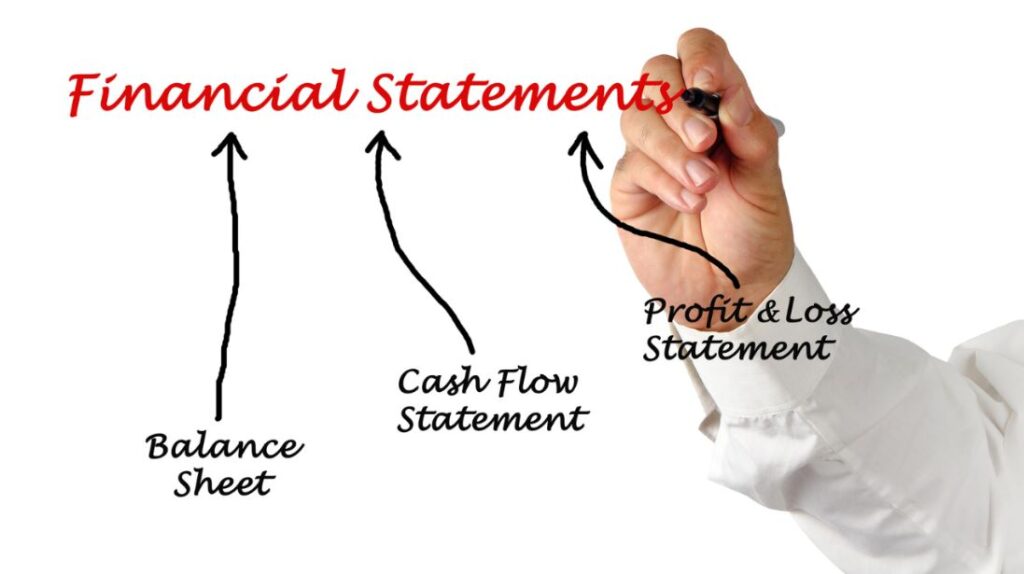

Anyone who invests in a firm must grasp the language of business. Ability to read financial statements is necessary for this. This might not be to everyone’s flavour. But don’t be turned off because it’s easy to understand the financial statements of a company than we think.

Let’s go over a brief example to gain a sense of the fundamentals.

Let’s say you have found a company that first appears to be a promising investment option. The balance sheet, income statement, and cash-flow statement are its three primary financial statements that you should review. How are they obtained? Any listed company’s financial statements are available on their website or in their exchange filing.

Let’s begin by discussing the balance sheet. It displays a company’s actual equity, or net worth. By totalling the company’s assets and deducting all of its obligations (including debts), you can calculate the net worth. Pay attention to the debt-to-equity ratio of the business. An investment prospect is better if the debt-to-equity ratio is lower.

Next comes the income statement. It will reflect the business’s net profit, which is calculated by deducting all its expenditures and taxes from revenue. Return on Equity (RoE) is the crucial parameter that we need to analyse. RoE is calculated by dividing net profit by equity (equity is generally referred to as “net assets” in their balance sheet). According to the author of this book, a RoE of more than 15% is considered to be rather good.

The cash-flow statement should be your last stop. It demonstrates how the business spends its funds. Does it have sufficient funds to run its daily operations? Does it settle its obligations on time? Are dividends paid to shareholders? In essence, you want to see steady, profitable cash flow each year.

Most companies occasionally have negative cash flow, which may be caused by sales cycles or large purchases. However, in general, you want to see a positive cash-flow history when you look backward at years of cashflow records.

Secret No. 6 – Know when to invest:

Just because a company’s financials are sound and successful doesn’t mean that you should invest in it. This is where valuation comes into the picture as a useful tool.

Generally speaking, you want to purchase stock when it is cheap and going to rise. The Net-Net approach is essential to this, which is the foundation of all value investing and was created by Buffett’s mentor Benjamin Graham.

The main idea behind Net-Net is to compare two numbers. The first is the Net Current Asset Value, or NCAV, of a business. It is sometimes called liquidation price. The net current asset value per share is the other number that you need to evaluate.

Let’s now examine the definition of a liquidation value. When a business sells everything to pay off its obligations, it is said to be in liquidation. What’s left over then is distributed to shareholders. That residue is all that NCAV is.

The balance sheet provides us with this figure. Both its entire obligations and current assets are available to you. NCAV is the result of deducting a company’s entire liabilities from its total current assets. Additionally, you would need to add up all of the company’s outstanding shares and divide the NCAV by the total number of outstanding shares in order to get the NCAV per share.

Thus, the authors conclude that the firm is undervalued if its NCAV per share exceeds its current market price. This is already a positive indication of a potential investment opportunity. The Net-Net approach by Ben Graham, however, takes it a step further. As per ben Graham, the present price per share should be one-third lower than the NCAV per share, who thought that the finest possibilities occur with a 33.3 percent margin of safety.

Secret No. 7 – Rules to manage a diverse and well-protected portfolio:

Prudent portfolio management is the key to building wealth through investments.

Nobody is always correct. Therefore, keeping a diversified portfolio is a wise strategy to allow for mistakes. It preserves overall profitability even if some investments stall or fail.

Warren Buffett’s portfolio consists of hundreds of private companies. However, he also owns stock in over 40 publicly traded firms. Buffett says “Diversification is protection against ignorance”.

Let us look into the five rules of portfolio management mentioned in this book:

- Allocation of funds – Prior to beginning an investment, choose how much you will spend now and how much you will save for later. This requires some clear-headed thinking. Buffett essentially left the investing game for four years in 1969 after realizing that everything was overpriced. His money was therefore protected throughout the 1971–1974 stock market crisis.

- Don’t invest more than 10% of your money in a single investment. We just refer to this as “diversification.” Avoid taking on too much at once.

- Carefully rank your prospects. Suppose you are considering 20 businesses. Spend some time ranking them according to your level of confidence in each. This will provide you a straightforward strategy: a firm deserves more of your money if it is ranked higher.

- Examine your portfolio on a yearly basis. Pay attention to the quarterly and annual reports that your company provide, and if you see any concerning patterns, make the necessary changes to your allocation.

- Don’t base your decision to sell a company or stock just on pricing. There is more to a good firm than its stock price. Amazing businesses occasionally see significant price reductions. Buffett actually enjoys investing when the stock price of a solid firm declines.

Final Words

You should now be able to begin making educated and prudent investments with the guidance of these seven investment secrets. These will provide you with a solid foundation, but they might not instantly turn you into a multimillionaire. You may undoubtedly find the way to build long-term riches through stock market investments by adhering to these secrets or, more accurately, these investing concepts. Buffett is correct when he states that “he invests in good businesses rather than stocks.”