For many investors, the pursuit of financial success centers on the potential for high returns. Among the myriad of investment options, direct stock investing often stands out as a compelling choice, offering substantial long-term rewards. However, achieving these rewards requires a disciplined and consistent approach.

Systematic Investment Plans (SIPs) have long been the beacon of disciplined investing, especially in mutual funds. But as the financial landscape evolves, a new strategy—Stock SIP—is gaining momentum. Think of it as applying the systematic principles of SIPs to individual stocks, creating a structured pathway to financial growth. Stock SIPs involve regular, interval-based investments in selected stocks, aiming to build wealth while averaging costs over time.

Let’s delve deeper into how Stock SIPs work, the factors to consider, and their benefits.

Table of Contents

Understanding Stock SIP

The essence of Stock SIP is systematic investing in individual stocks at regular intervals. By consistently contributing a fixed amount, investors can potentially reduce the impact of market volatility. Over time, this approach helps establish an average cost for the stocks, making it a compelling strategy for long-term wealth creation.

In mutual funds, SIPs allocate units corresponding to the invested amount, offering exposure to a diversified portfolio. Stock SIPs, while similar in structure, focus on specific companies. Each month, you allocate a predetermined sum to purchase shares of chosen stocks, building a concentrated portfolio aligned with your financial goals.

Key Steps to Execute a Stock SIP

1. Choose Your Stocks Wisely

The cornerstone of a successful Stock SIP is selecting the right stocks. This process demands meticulous analysis and foresight. Consider these factors:

- Financial Metrics: Examine revenue growth, profit margins, and debt levels.

- Future Potential: Assess the company’s long-term growth trajectory.

- Industry Trends: Understand the broader market context.

A diversified and balanced selection of high-quality stocks lays the foundation for a resilient portfolio. For instance, if you identify a technology company poised to lead in artificial intelligence, your regular investments can align with its growth trajectory. This careful curation ensures you’re investing in companies that align with your financial objectives.

2. Reinvest Dividends

Dividends, often viewed as passive income, can be a powerful tool when reinvested. By channeling dividends back into the same stocks, you amplify the compounding effect, accelerating your portfolio’s growth. This disciplined approach not only enhances capital appreciation but also builds a robust income stream over time.

For example, if a company pays a dividend of ₹50 per share and you reinvest it to purchase additional shares, these reinvested shares will themselves generate dividends in the future, creating a snowball effect. Over the years, this strategy can significantly enhance your portfolio’s value.

3. Monitor and Review

Creating a Stock SIP is just the beginning. Ongoing monitoring and regular assessments are crucial for:

- Evaluate Performance: Identify underperforming stocks.

- Rebalance Portfolio: Adjust allocations to maintain diversification and align with goals.

- Adapt to Market Changes: Stay agile to optimize returns.

Proactive oversight guarantees that your portfolio stays in sync with changing market trends and your financial goals. For example, if a stock’s fundamentals weaken or its industry outlook changes, it might be prudent to replace it with a more promising option.

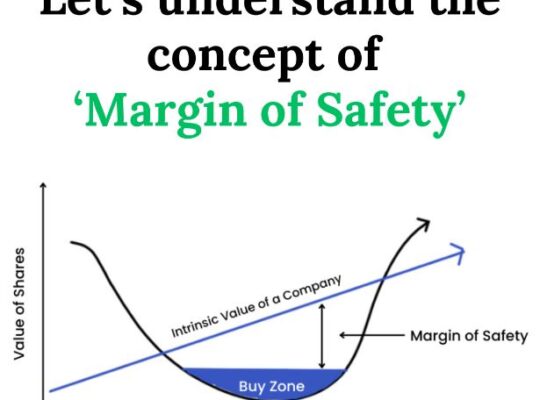

4. Leverage Rupee-Cost Averaging

Stock SIPs naturally implement rupee-cost averaging, which means you buy more shares when prices are low and fewer shares when prices are high. This strategy minimizes the impact of market volatility and ensures you don’t need to time the market. Over time, this consistent approach can smooth out the fluctuations and lead to better average purchase prices.

Benefits of Stock SIP

1. Greater Control

Stock SIPs empower investors with unparalleled control over their investments. Unlike mutual funds, where diversification is pre-set, Stock SIPs allow you to handpick stocks, tailor your portfolio, and respond swiftly to market shifts. This hands-on approach fosters a deeper understanding of market nuances and facilitates customized risk management.

For example, if you’re confident in the growth potential of renewable energy, you can allocate your Stock SIP contributions specifically to companies in this sector. This targeted approach allows you to capitalize on emerging trends and align your investments with your convictions.

2. Potential for Higher Returns

Direct stock investing offers a unique advantage—the potential for substantial returns by participating directly in the success of chosen companies. While this approach carries inherent risks, they can be mitigated through informed decision-making and diversification. With diligence and a long-term perspective, Stock SIPs can unlock significant wealth.

For instance, historical data shows that long-term investments in companies like Infosys or TCS have delivered exponential returns to investors who believed in their vision and stayed invested.

3. Customization

Every investor’s journey is unique, shaped by distinct financial goals and risk appetites. Stock SIPs offer the flexibility to design a portfolio tailored to individual aspirations. Whether it’s achieving specific milestones or managing risk, customization ensures your investment strategy aligns seamlessly with your personal vision.

Customization also allows you to align your portfolio with ethical or sustainable investment preferences, such as focusing on environmentally responsible companies or those championing social causes.

Caution Around Diversification

A notable contrast between Stock SIPs and mutual fund SIPs lies in diversification. Stock SIPs inherently focus on individual companies, lacking the automatic diversification of mutual funds. This singular focus increases risk, as your portfolio’s success is tied directly to the performance of the selected companies.

To achieve diversification in Stock SIPs, consider:

- Establishing Multiple SIPs: Invest in a range of companies across sectors.

- Allocating Effort: Regularly contribute to and manage each SIP.

For example, creating Stock SIPs in companies from different sectors—such as IT, healthcare, and manufacturing—can mitigate the impact of a downturn in any single industry. While some brokerage platforms offer automated Stock SIP services, active management remains crucial. For novice investors, the simplicity of mutual fund SIPs might be a more accessible starting point.

Defining the Purpose of Stock SIP

Clarity of purpose is the North Star of any investment strategy. In Stock SIPs, the goal should transcend mere cost averaging during price dips. Instead, focus on long-term accumulation in fundamentally strong companies. Here’s how:

- Scenario 1: If a stock’s price drops but the company’s fundamentals remain robust, use this as an opportunity for strategic accumulation.

- Scenario 2: Set a clear objective to build a specific investment amount over time, systematically purchasing shares each month.

This purposeful approach ensures you’re not reacting to short-term market movements but aligning with the company’s long-term potential and strategic plans.

For example, if you believe in the growth potential of a company like Reliance Industries, a Stock SIP allows you to gradually build a significant stake over time, irrespective of market fluctuations.

Conclusion

A well-executed Stock SIP is your compass, guiding you through the volatile seas of the stock market. By systematically accumulating shares in high-potential companies, you’re laying the groundwork for sustainable wealth creation.

Remember, Stock SIPs are not impulsive decisions but deliberate steps towards your financial aspirations. With discipline, careful planning, and consistent effort, Stock SIPs can become a cornerstone of your investment journey, bringing you closer to your financial goals, one step at a time. By embracing this structured approach, you equip yourself to navigate market uncertainties with confidence, making every investment a stepping-stone to long-term success.

Check out my other article in my blog on how to choose perfect stocks for beginners, in which I have tried to bring out an easy-to-follow approach. You can give it a read through as well.

Follow me on Quora for more insightful posts on personal finance, investments, money management, and more!