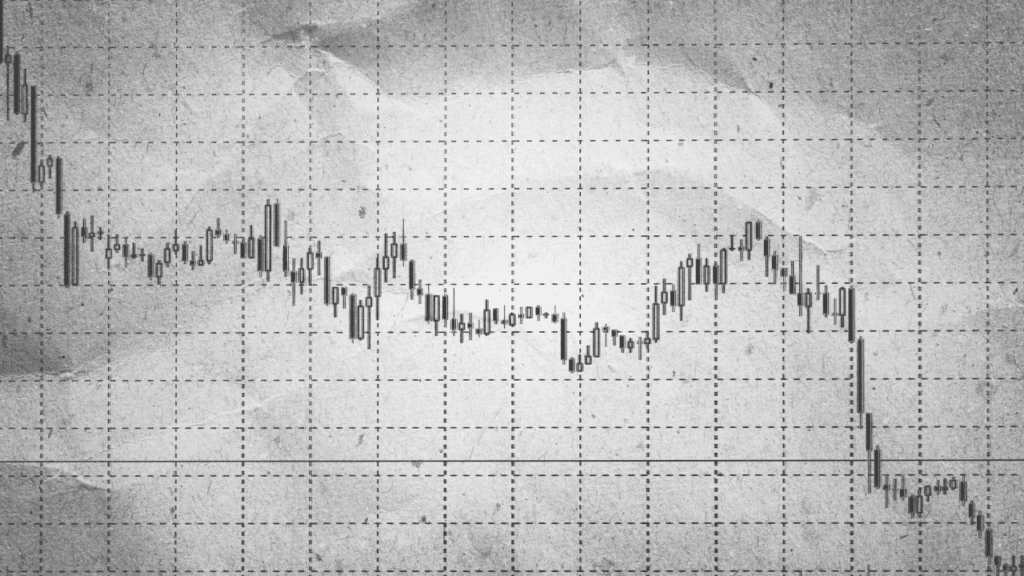

The stock market can be a rollercoaster ride, and many investors make costly mistakes along the way. While there are countless ways to lose money in the stock market, some mistakes are more common than others. Here’s a list of the most typical ways people lose their money fast:

- Start trading for quick profits.

- Trade Forex from home with no experience.

- Dive into Futures & Options without understanding them.

- Trade impulsively with overconfidence.

- Chase intraday trades without a strategy.

- Act on “inside information.”

- Buy falling stocks, thinking they can’t drop further.

These are just a few ways you can quickly lose money in the stock market. But there’s one modern trend that deserves special attention—paying ₹10,000 for a course on how to “trade like a pro.”

The Stock Market Education Scam

In today’s world, it’s easy to find “quick fixes” and promises of instant success in the stock market. Many courses claim to teach you how to trade like an expert, but in reality, they often leave you with empty pockets. These “too-good-to-be-true” trading programs flood the market, offering unrealistic promises and making it easy to part with your money.

The truth is, there’s no shortcut to success in the stock market. Trading requires knowledge, discipline, and patience. No course can “deliver” success overnight. Instead, these courses often serve as an introduction to a long and ongoing learning process, one that requires a lot of work, not just a hefty payment.

The Reality of Stock Market Trading

To succeed as a trader, you need more than just a course—you need a strong sense of purpose. Think of it like joining a gym: many people sign up but give up after a month because they lack the drive and commitment. The same applies to trading. Without passion, dedication, and a clear goal, you will likely waste both time and money.

It’s essential to ask yourself: What’s your purpose in trading? Are you looking for financial freedom, or is it just a passing interest? Without a clear, specific goal, trading will likely become just another “get-rich-quick” fantasy that leaves you disappointed.

Understanding Risk and Capital

Another crucial factor is understanding risk capital. You should only use money you can afford to lose. Trading with money you can’t afford to risk can lead to “loss aversion”—the fear of losing money—which can paralyze your decisions and lead to mistakes.

Most people enter trading with the expectation of making quick profits. But the truth is, trading is about exploiting small advantages over a long period. This requires maturity, discipline, and patience. Ask yourself: Do you have the mindset to wait for long-term gains?

Watch Out for Hidden Agendas

Many so-called trading courses have hidden motives, such as upselling software, data feeds, or access to their trading platforms. These educators often focus more on selling additional products than actually teaching you how to trade successfully. Always be wary of programs that promise “easy money” and don’t offer transparency.

The price of a course is not a direct indicator of its quality. Often, the more you pay, the more polished the marketing, not the content. Many courses take a long time to explain basic principles that could easily be learned from a book or through free resources.

Learn to Trade, Not Just Technical Analysis

There’s a big difference between learning to trade and just learning technical analysis. Many courses focus solely on charts and patterns, but the reality is that true trading success comes from understanding the process and making decisions based on experience. Trading isn’t just about learning strategies; it’s about gaining the confidence to make informed decisions in real-time, which comes only with practice.

Questions to Ask Before Signing Up

Before committing to any trading course, ask yourself these important questions:

- What am I really buying? Is this a course with actual mentoring, or am I just getting a series of PDFs?

- Can I easily cancel my subscription? If a course makes it difficult to cancel, it’s a red flag. Integrity matters.

- What’s the real value? Will I get anything tangible, like one-on-one mentorship, or just a set of generic materials?

- What’s their motive? Are they genuinely trying to educate, or just trying to get you to trade on their platform and pay fees?

- Who are the people behind the course? Look for real names, faces, and addresses. Avoid faceless entities with no clear identity.

- Can I learn this from a book? If so, save your money and just read the book.

Do You Really Want to Trade?

The most important question to ask yourself is: Do you really want to be trading full-time? Successful traders spend hours in front of their screens, analyzing data and making decisions. It’s a demanding job, and it’s not for everyone.

While some people genuinely enjoy the process of stock market trading, most will find it too time-consuming, stressful, and damaging to their relationships. It’s a niche activity that requires dedication, and most people won’t have the patience to stick with it long enough to see substantial gains.

Final Thoughts: Beware of “Get-Rich-Quick” Schemes

In the end, the path to trading success is not about shortcuts or flashy courses. It’s about understanding the market, managing risk, and building a strategy that aligns with your goals. Avoid falling for the temptation of quick riches, and focus on the long-term process of becoming a disciplined, informed trader.

You can also check out my other article on the top behavioral finance mistakes that are causing you to lose money.

Do Follow me on LinkedIn for more such insights on personal finance, investments, money management, and more!