When it comes to long-term investing, few names shine as brightly as Charlie Munger. Alongside Warren Buffett, Munger co-built Berkshire Hathaway into a powerhouse that exemplifies the art and science of value investing. Over 58 years, the duo achieved a compounded annual return of 19%, a remarkable achievement in the world of finance. Even more impressive, Berkshire Hathaway has posted share price gains in 47 of those 58 years.

What’s the secret behind this extraordinary success? It’s not market timing or high-frequency trading, but a steadfast commitment to foundational principles, a focus on the long-term, and an uncanny ability to identify value where others may not. Let’s dive into the incredible journey of Berkshire Hathaway and the timeless wisdom of Charlie Munger.

The Secret Sauce: A Buy-and-Hold Philosophy

At the heart of Berkshire Hathaway’s strategy lies the principle of buy-and-hold investing. Munger and Buffett have consistently shown that patience and conviction are far more powerful than short-term speculation. This philosophy echoes the approach of legendary cricketer Rahul Dravid, whose coaching strategy involves giving players a “long rope” to demonstrate their potential. Similarly, Berkshire gives businesses the time and resources to grow, thrive, and deliver returns over decades.

Longevity in the Portfolio

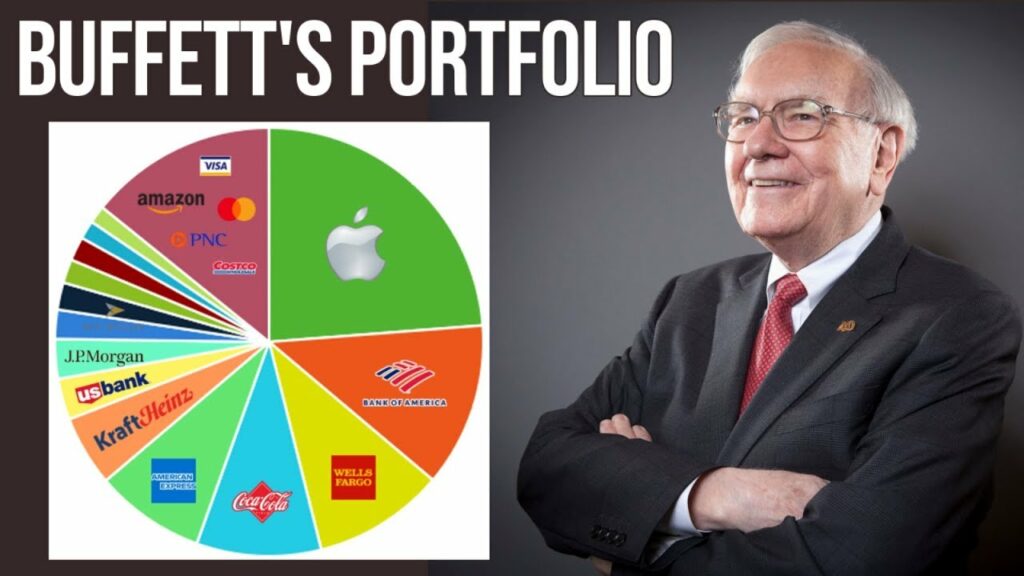

A glance at Berkshire’s holdings over the decades highlights this approach:

| 1980 | 1990 | 2000 | 2010 | 2023 |

| GEICO | Coca-Cola | Coca-Cola | Coca-Cola | American Express |

| General Foods | Capital Cities | American Express | Wells Fargo | Apple |

| Handy & Harman | GEICO | Gillette | American Express | Bank of America |

| SAFECO | Washington Post | Wells Fargo | Procter & Gamble | Coca-Cola |

| Washington Post | Wells Fargo | Washington Post | Kraft Foods | Chevron |

Take Coca-Cola, for example. Berkshire began building its position in 1988. Over the years, Coca-Cola has remained a cornerstone of the portfolio, appearing among the top holdings in 1990, 2000, 2010, and even in 2023. Similarly, businesses like American Express, Wells Fargo, and the Washington Post have enjoyed decades of commitment from Berkshire.

From Textile Mill to Conglomerate: The Berkshire Story

Originally, Berkshire Hathaway was a struggling textile company. In 1964, Warren Buffett acquired a 7% stake, intending to profit from an eventual exit. However, instead of cashing out, Buffett stayed on, gradually transforming the company with Munger’s guidance.

A Shift in Philosophy

Munger’s influence was pivotal. He encouraged Buffett to move from buying “fair businesses at wonderful prices” to “wonderful businesses at fair prices.” This shift marked a turning point in Berkshire’s evolution. By 1980, Berkshire had about $1 billion in assets. Approximately half of these assets were investments in listed stocks, while the other half consisted of businesses it owned outright, spanning sectors like insurance, textiles, retailing, and newspapers.

Fast forward to 2024, and Berkshire’s assets had grown to an astonishing $1.14 trillion, representing a compounded annual growth rate of 18%. Of this, approximately $371 billion was invested in publicly listed companies, with the rest housed in businesses owned entirely by Berkshire. Today, Berkshire is a sprawling conglomerate comprising about 70 companies across diverse sectors such as railroads, energy, aviation, and fast food.

Value Investing: The Core Philosophy

The cornerstone of Berkshire’s success is its unwavering commitment to value investing, a philosophy championed by both Buffett and Munger. This approach is based on a set of timeless principles that guide every investment decision:

- Invest in businesses, not just stocks. View each investment as a partial ownership in a business.

- Buy at a good price. Focus on acquiring assets at a fair valuation rather than chasing high-growth narratives.

- Look for a competitive moat. Great businesses often have durable competitive advantages, such as strong branding, customer loyalty, or regulatory protections.

- Stay within your circle of competence. Avoid investing in industries or companies you don’t fully understand.

- Prioritize cash flows and profitability. Growth is important, but a business must generate consistent cash flows.

- Don’t overpay. Even the best business is a poor investment if purchased at an exorbitant price.

- Be patient. Allow time for your investments to bear fruit.

- Ignore market noise. Focus on the fundamentals of the stocks you invest in.

This philosophy may seem simple, even unglamorous, but its results speak for themselves. By adhering to these principles, Berkshire has consistently outperformed the broader market, proving that discipline and clarity trump hype and speculation.

Letters to Shareholders: A Masterclass in Transparency

A defining feature of Berkshire Hathaway is its commitment to transparency, exemplified by Warren Buffett’s annual letters to shareholders. These letters, written in plain language, offer insights into Berkshire’s performance, investment decisions, and the lessons learned along the way.

A word cloud of Buffett’s letters from the past 45 years reveals recurring terms like earnings, value, price, shareholders, profit, and growth. These core ideas underscore Berkshire’s dedication to value investing and its focus on delivering long-term shareholder value. The letters also reflect a culture of accountability, with Buffett openly admitting to mistakes and sharing the reasoning behind key decisions.

Timeless Wisdom from Charlie Munger

Charlie Munger’s contributions to Berkshire Hathaway go beyond numbers. His wisdom has shaped the company’s philosophy and continues to inspire investors worldwide.

Here are some his famous quotes:

- “Warren and I don’t focus on the froth of the market. We seek out good long-term investments and stubbornly hold them for a long time.”

- “There is no such thing as a 100% sure thing when investing. Thus, the use of leverage is dangerous.”

- “The world is full of foolish gamblers, and they will not do as well as the patient investor.”

Munger’s advice isn’t limited to investing. His thoughts on lifelong learning, adapting to change, and practicing discipline resonate universally, offering valuable lessons for both professional and personal success.

For more of Munger’s life lessons, check out my article on his invaluable words of wisdom.

The Power of Partnership

One of the most compelling aspects of Berkshire Hathaway’s success is the partnership between Warren Buffett and Charlie Munger. Their collaboration is built on mutual respect, complementary skills, and a shared vision.

Buffett’s admiration for Munger is evident. In his letter marking Berkshire’s 50th anniversary, Buffett wrote: “Charlie has a wide-ranging brilliance, a prodigious memory, and some firm opinions. When we differ, Charlie usually ends the conversation by saying: ‘Warren, think it over, and you’ll agree with me because you’re smart, and I’m right.’”

Their ability to deliberate on decisions, commit fully, and stay the course has been instrumental in shaping Berkshire’s legacy. For example, the top five holdings in Berkshire’s stock portfolio often account for 60% or more of its total value, reflecting their high-conviction approach.

A Legacy of Unmatched Returns

Berkshire Hathaway’s performance is a testament to the power of disciplined investing. In March 1980, a $1,000 investment in Berkshire would have purchased 3.44 shares. Today, that investment would be worth $1.88 million, delivering an annual return of 19%—nearly double that of a benchmark American stock index over the same period.

However, the real legacy of Munger and Buffett lies not just in numbers but in the philosophy they’ve championed. Their approach underscores the importance of patience, understanding, and a commitment to creating long-term value.

Conclusion: The Legacy of Vision and Patience

Charlie Munger and Warren Buffett’s journey with Berkshire Hathaway is a masterclass in investing, leadership, and collaboration. Their success underscores the power of staying disciplined, focusing on fundamentals, and taking a long-term view. Berkshire’s story is more than just financial achievement; it’s a philosophy of life that celebrates thoughtful actions, enduring principles, and trust in the process.

As investors, there is much to learn from their legacy. Whether it’s the importance of patience, the value of understanding, or the courage to stay the course, the lessons of Munger and Buffett are timeless. Their story is a beacon for those seeking not just financial success but a deeper understanding of what it means to create and sustain value.

Do follow me on Linkedin, where I post useful insights on investments, personal finance, money management, debt management, etc.