What will be your equity investment outcome if you were the most ‘unfortunate’ investor?

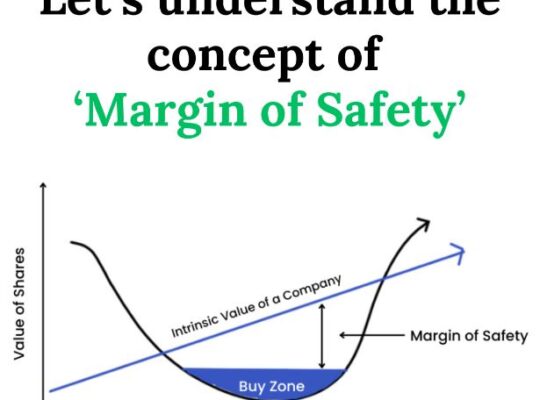

It is well recognized that the stock market is dynamic, unpredictable, and volatile. There are several (macro and micro) aspects that make it very difficult to anticipate stock prices accurately, including politics, the state of the world economy, unforeseen circumstances in the country’s economy, a company’s financial performance, and more. As investors, we worry about …