Investing in the stock market is often painted as a fast track to riches. However, the real story behind building wealth through direct stock investments is one of patience, strategy, and continual learning. In this blog post, we explore the core principles of direct stock investing in a simple, rather thought-provoking manner.

Table of Contents

A New Perspective on Investing

When we talk about investing, it’s important to understand that success rarely happens overnight. Unlike a quick win in a game or a flash of luck, growing your wealth through the stock market is much more like running a marathon. It demands time, effort, and above all, consistency. The financial markets are in constant flux, reacting to everything from economic policies to global events. This dynamic environment means that to succeed, you must approach investing with a clear plan and a long-term perspective.

At its core, direct stock investing means buying shares of companies with the aim of benefiting from their growth over time. It’s a process that requires more than just following market tips or acting on a hunch. Instead, successful investors take the time to understand the business, study trends, and develop a strategy that aligns with their financial goals. This careful planning sets the stage for sustainable growth and wealth creation.

Why Direct Stock Investing can be exciting

Many people find the idea of investing in stocks thrilling because it offers a direct connection to the world’s most influential companies. Unlike other investment vehicles such as mutual funds or insurance products, direct stock investing gives you a sense of ownership. When you purchase a share, you’re not just buying a piece of paper, you’re investing in a company’s future. This hands-on approach can be highly rewarding, both intellectually and financially.

However, the excitement of watching a stock’s value rise should not overshadow the importance of maintaining a disciplined approach. Stock prices can be unpredictable, and without a clear strategy, it’s easy to be swept up in market hype or panic when prices fall. The key is to remain calm and focused, regardless of short-term fluctuations, and to let your well-researched plan guide you.

Building Wealth: It’s a Marathon, not a Sprint

The most successful investors view the market as a long-term opportunity rather than a quick fix. Building wealth through direct stock investing is similar to training for a long race: it requires steady progress, endurance, and the willingness to stick to your plan even when the going gets tough.

Patience and Persistence

One of the most important lessons in investing is to be patient. Market downturns are inevitable, and they can test even the most seasoned investor’s resolve. The temptation to sell when prices fall is strong, but doing so often locks in losses and can derail your overall strategy. Instead, consider these dips as temporary setbacks in an otherwise upward-trending journey.

A well-thought-out investment plan considers these fluctuations. It is built on the principle that, over time, the market tends to reward those who stay the course. This is why a long-term perspective is essential: it allows the power of compounding to work its magic, turning small, consistent gains into significant wealth over many years.

The Importance of a Diversified Portfolio

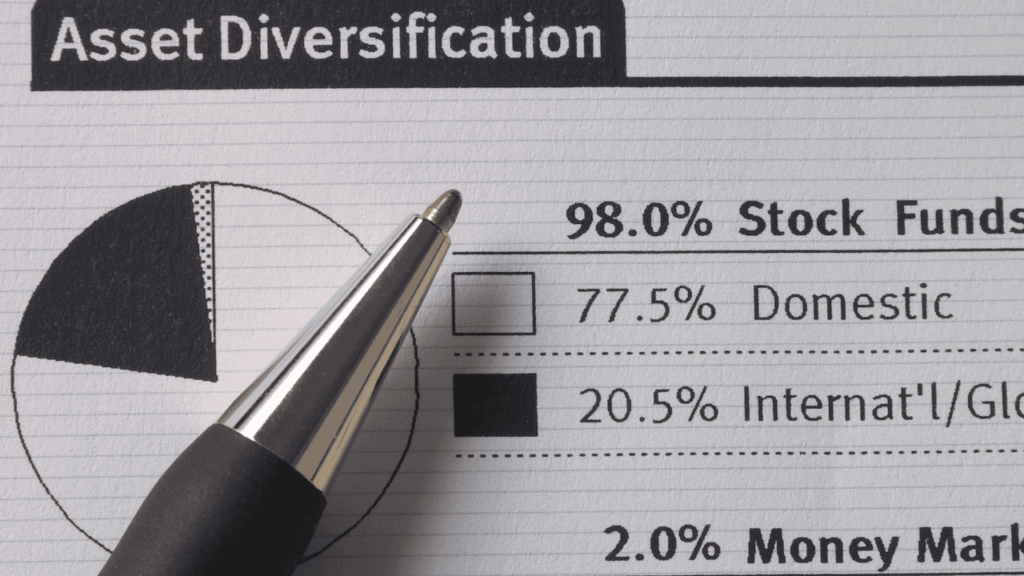

One of the cornerstones of effective investing is diversification. While direct stock investing can be a key component of your wealth-building strategy, relying solely on stocks can expose you to unnecessary risk. A diversified portfolio spreads your investments across different asset classes, reducing the impact of any single market event on your overall financial health.

Why Diversification Matters

Imagine placing all your savings into one basket. If that basket were to fall, you’d lose everything. In the context of investing, putting all your money into one type of asset, such as stocks, can be risky. By diversifying, investing in stocks, bonds, and other asset classes, you create a safety net that can cushion your portfolio against market volatility.

Even within the stock market, diversification is vital. Allocating your investments among large-cap, mid-cap, and small-cap companies ensures that your portfolio is balanced. Large-cap stocks tend to offer stability, mid-caps can provide growth opportunities, and small-caps often yield higher returns over the long term, albeit with increased risk. The idea is to blend these elements in a way that aligns with your risk tolerance and investment goals.

Mastering the Art of Stock Selection

Selecting the right stocks is as much an art as it is a science. It involves a careful blend of quantitative analysis and qualitative judgment. Many investors fall into the trap of chasing the latest market trends or reacting impulsively to news headlines. Instead, a more successful approach is to base your decisions on thorough research and a clear understanding of a company’s fundamentals.

Strategic Stock Picking

The process of stock selection starts with understanding a company’s business model. Look for companies that have a solid strategy, competitive advantages, and a track record of consistent performance. Financial metrics such as the price-to-earnings (P/E) ratio can be useful, but they should not be the only factor in your decision-making process. Instead, combine these figures with an analysis of the company’s management, market position, and growth potential.

Trading, which often focuses on short-term gains, is a very different beast from investing. Many people get drawn to trading because of the allure of quick profits. However, statistical evidence suggests that most traders end up losing money over time due to the inherent risks and stress of constant market monitoring. For most, a well-rounded investment strategy that includes carefully selected stocks is a far more sustainable path.

Navigating Global and Local Market Influences

Stock markets do not exist in a vacuum. They are deeply influenced by political, economic, and social developments both at home and abroad. For investors, understanding these external factors is crucial to making informed decisions.

The Impact of Global Events

Economic policies, inflation rates, and geopolitical events can all affect the performance of the stock market. For example, changes in interest rates in major economies can have ripple effects on markets around the world, including in emerging economies. This means that even if you invest primarily in local companies, you cannot ignore global economic trends. By staying informed about these developments, you can better anticipate market shifts and adjust your portfolio accordingly.

The Role of Fundamental Analysis

To mitigate the risks posed by these external factors, a robust investment approach is based on fundamental analysis. This involves examining the intrinsic value of companies by looking at their financial health, competitive positioning, and future growth prospects. By investing in companies with strong fundamentals, you can better withstand market turbulence. This strategy not only helps protect your investments during downturns but also positions you to capitalize on growth when market conditions improve.

The Power of Starting Early

One of the most powerful strategies in the world of investing is to begin as early as possible. Time is one of your most valuable assets when it comes to building wealth. Starting early allows your investments to benefit from the compounding effect, where the returns on your investments generate their own returns over time.

The Magic of Compounding

Compounding works much like a snowball rolling down a hill, gradually gathering more mass as it moves forward. Even small contributions can grow substantially over a long period, as the interest earned on your investments is reinvested to generate further earnings. This exponential growth is why financial advisors often stress the importance of beginning your investment journey sooner rather than later.

Long-Term Vision

A long-term outlook helps you navigate the inevitable ups and downs of the stock market. When you focus on building wealth over decades rather than days or months, you can better ride out temporary setbacks. The market’s historical trend shows an upward movement over the long term, reinforcing the idea that perseverance and patience are key to successful investing.

Steering Clear of Emotional Investing

It’s natural to feel anxious when the market experiences a downturn. However, reacting emotionally, especially by selling off your investments in a panic, can be detrimental to your financial goals. One of the biggest mistakes investors make is to let fear dictate their actions.

Staying Calm During Volatility

When the market drops, the instinct might be to cut losses and exit your positions immediately. This impulsive reaction can lead to selling at a loss, thereby locking in the negative performance instead of waiting for a potential rebound. A calm and measured approach is essential. Stick to your strategy, review your long-term goals, and avoid making hasty decisions based on short-term market movements.

The Role of Discipline

Maintaining discipline is a recurring theme in successful investing. It’s about setting clear guidelines for your investments and adhering to them, even in turbulent times. By establishing predetermined criteria for buying, holding, and selling stocks, you create a framework that helps you manage your emotions and make rational decisions.

Uncovering Hidden Investment Opportunities

For investors looking to maximize their returns, identifying undervalued companies can be a goldmine. The process involves a combination of mathematical analysis and careful judgment. Often, a company’s stock may trade at a lower price than its true worth, presenting an opportunity for savvy investors.

The Quest for Value

Mathematical models, such as the P/E ratio, provide a starting point for evaluating whether a stock is undervalued. However, numbers alone don’t tell the whole story. It’s equally important to understand why a company might be undervalued. Are there external factors affecting its stock price, or is the market simply overlooking its long-term potential? Delving into these questions requires a mix of analytical skills and market insight.

Balancing Value and Growth

While the concept of value investing focuses on identifying undervalued stocks, it’s important to note that growth stocks also play a critical role in a diversified portfolio. Growth companies often enjoy rapid expansion, but they can come with higher price tags due to market expectations. Balancing these two types of stocks, value and growth, can help optimize your portfolio’s performance while managing risk.

Crafting the Ideal Asset Allocation

Every investor is unique, with different risk tolerances, financial goals, and time horizons. For those who are more risk-averse, designing an asset allocation that minimizes exposure to volatile markets is essential. This means carefully selecting a mix of investments that not only offer growth potential but also provide stability during turbulent times.

Strategies for Risk-Averse Investors

One approach for those seeking a balanced return is to invest in funds that blend both debt and equity instruments. For instance, balanced advantage funds typically allocate about 30-35% of their holdings to debt and the rest to equity. This mix allows fund managers to adjust the ratio based on current market conditions, providing a buffer against sudden market shifts.

For investors who prefer direct stock investment, a similar principle applies. A conservative strategy might involve dedicating a significant portion, perhaps 60-65%, to less volatile debt instruments, while investing in a select group of well-researched companies. This method not only manages risk but also offers a stable foundation for long-term growth.

Customizing your Investment Plan

No single asset allocation fits everyone. Factors such as your age, income, and future financial needs should guide how you divide your investments. By regularly reviewing and adjusting your portfolio, you can ensure that your strategy remains aligned with your evolving goals. This customization is key to maintaining a balanced approach in a world of unpredictable market conditions.

The Often-Overlooked Importance of Tax Planning

Taxes can have a significant impact on your investment returns. The money you save on taxes can be reinvested, further compounding your wealth over time. It’s essential to understand the tax implications of different investment vehicles and to plan accordingly.

Tax Considerations for various Investments

For instance, investments like debt mutual funds and fixed deposits are fully taxable, with the tax rate depending on your income slab. In contrast, certain schemes, such as the National Pension System (NPS), offer attractive tax benefits, sometimes reducing the effective tax burden by a considerable margin. Exploring these options and integrating them into your investment plan can lead to meaningful savings over the long term.

Optimizing Your Tax Strategy

Tax planning should not be an afterthought in your investment strategy. By considering tax implications from the start, you can make smarter decisions about where and how to invest your money. This proactive approach helps in preserving your gains and allows more of your money to work for you. Whether it’s through tax-efficient funds or strategic asset allocation, managing your tax liability is a critical component of building lasting wealth.

Final Thoughts

In summary, direct stock investing offers a unique blend of excitement and responsibility. It is a field where deep analysis, diversified strategies, and a long-term vision combine to create opportunities for genuine wealth creation. The journey requires you to balance enthusiasm with caution, to celebrate the power of compounding while remaining realistic about market risks, and to constantly refine your approach in response to both global and local economic shifts.

Ultimately, every investor’s journey is personal. The art and science of direct stock investing is not about chasing quick wins, it’s about building a legacy of financial stability that can support you for years to come. Invest wisely, remain steadfast in your strategy, and let time be your greatest ally in the quest for lasting wealth.

You can also check my other article on how and is Direct Stock Investing suitable for everyone.

Do follow me on Linkedin and Quora for more insightful posts related to personal finance, money management, investments, debt management, etc.