A mutual fund’s systematic withdrawal plan (SWP) can provide consistent income while minimizing taxes. An SWP is the inverse of a systematic investment plan (which involves regular investments).

One can take a certain amount annually from a mutual fund using an SWP. Any mutual fund scheme can have an SWP set up. However, if the fund has less than 65% debt, the tax benefits are maximized. Depending on the amount of equity exposure in the fund, these funds are subject to a 12.5% long-term capital gains tax.

For instance, you may use an SWP to take Rs. 30,000 a month at an 8% withdrawal rate from an investment of Rs. 50 lakh. Depending on the returns from your corpus and the withdrawal rate, the SWP may exhaust the funds more quickly or more slowly. Equity mutual fund is typically expected to yield a 12% return over the long run. As a precaution, you should expect a 10% return from the mutual fund. If you set the SWP rate lower than 10%, your corpus might not decline rapidly over time.

Tax optimization is one of SWP’s main advantages. Since each withdrawal is seen as both a capital and a return, it is not subject to full taxation. It’s possible that just Rs. 1 lakh of a Rs. 5 lakh withdrawal from a Rs. 50 lakh investment is a taxable gain; the remaining amount is regarded as a capital withdrawal and is thus exempt from taxes. In contrast to fixed deposits, this reduces the effective tax due to be paid.

Is SWP suitable for retirees?

An SWP gives investors a mechanism to take planned withdrawals from their portfolio while keeping an appropriate asset allocation, which is especially helpful for those in the post-retirement phase. Even though a larger withdrawal amount might seem alluring, it’s crucial to check and modify this amount frequently.

Many retirees first overestimate their costs, but changes are frequently made after a realistic appraisal a few months after retirement. After a few months of retirement, check the SWP amount to make sure it matches your true needs.

Inflation factor:

Most individuals factor inflation into their retirement plans up until they reach retirement, but they frequently forget how inflation will affect their spending in the years after retirement. This is where an SWP comes in handy since you may increase the SWP amount each year. For instance, our retiree Karthik may have enough money in the early years if he begins taking out Rs. 70,000 a month after retirement. But in a few years, his cost of living may rise to Rs. 1 lakh a month due to inflation. He should hence stay up with inflation and extend the life of his retirement corpus by regularly adjusting his withdrawals with an SWP. When employing SWP, maintain a long-term view. Using past market collapses as examples, such as the 2008 financial crisis and the 2020 COVID-19 pandemic, investors with a long-term view have generally seen their portfolios rebound and outperform inflation over time.

For retirees who depend on their portfolios to sustain them for decades, the corpus’ resilience or longevity is crucial.

Mitigating risk:

Retirees will find a “bucketing strategy” helpful in managing risk. For example, assume that Mr. Karthik has a retirement corpus of Rs. 2 crore. He may split his retirement fund of two crore into three parts:

- Rs. 60 lakh (30%) in hybrid funds focused on debt with little exposure to equities.

- Rs. 60 lakh (30%) in hybrid funds focused on equities.

- Rs. 80 lakh (40%) in pure equity funds.

Financial advisors usually advise retirees to begin taking withdrawals from the first bucket, followed by the second and third. This allows the equity component to expand and compound over time.

By using this approach, the equity component can increase over time while the presently occurring withdrawals are from the debt hybrid funds and hence are shielded from market fluctuations.

Because debt funds and hybrid funds have generally stable net asset values (NAVs), diversifying your mutual fund portfolio can lower the risk of selling more units during bear markets.

The debt component won’t be impacted even if the equity markets drastically drop. Due to their reduced equity component, hybrid funds can have a lesser decline; thus, they won’t have an impact on the SWP from the first bucket during the initial years.

SWPs in equity-oriented hybrid funds are also eligible for a Rs. 1.25 lakh exemption and a reduced capital gains tax rate of 12.5% after holding for more than a year.

Proper Planning is vital:

In order to have enough time to establish a solid mutual fund portfolio, retirees should begin preparing their SWP strategy two to three years prior to their retirement. This will shield them against abrupt market declines that might erase years’ worth of profits.

By taking advantage of long-term capital gains tax rates when taking money out of equity investments, this strategy can also help with tax optimization. In the long term, it also prevents hasty decisions. Making the right plans guarantees that your retirement lifestyle will be maintained by inflation-adjusted withdrawals.

Adjust SWP to one’s own requirements:

A one-size-fits-all withdrawal rate, such as the widely used 4% guideline, is not necessarily appropriate in the Indian setting. This 4% withdrawal rate was designed in the United States, where market returns and inflation rates vary. Furthermore, these withdrawal rates must be customized for each individual’s unique financial situation.

Therefore, we must first ascertain the best withdrawal rate and then modify it as one’s financial situation changes over time. This will guarantee the corpus’s longevity without sacrificing the quality of life after retirement.

Tax treatment of these SWPs:

The possibility of deferring taxes is one of the main advantages of an SWP. Mr. Karthik is exempt from paying taxes on the entire Rs. 70,000 he withdraws each month. Taxes are only applied to the portion that represents his investment profits or capital gains. The remainder, which was his initial investment, is exempt from taxes.

In addition, the first-in, first-out methodology is used to determine taxes. Accordingly, the retiree’s withdrawals are seen as having originated from his initial investments. If he invested Rs. 1 lakh in 2014 and another Rs. 1 lakh in 2015, the first Rs. 70,000 withdrawal will be taxed according to the profits on his 2014 investment. The retiree can delay paying taxes on his more recent investments by using this strategy.

Final words:

SWP provides a dependable and adaptable method of controlling risk and taxes while making money from investments. Additionally, withdrawals must be regularly monitored. By using a bucketing approach, you can safeguard your portfolio from market fluctuations.

In the end, an SWP is a useful tool for retirees because it provides flexibility, tax efficiency, and a consistent income—all of which are essential for a comfortable and secure retirement.

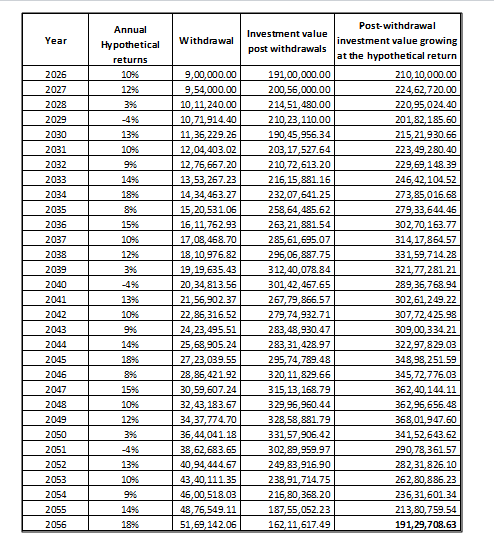

A small math:

I have done the calculation for the starting corpus of Rs. 2 crore in the below table. The assumed withdrawal rate is 4% per year of the initial corpus, with the withdrawals rising by 6% annually to keep pace with inflation. I have assumed the withdrawal rate at 4.5% here because Karthik requires only Rs. 70,000 per month for his expenses. Hence I have tried to keep that in mind, and hence I have assumed 4.5% withdrawal rate. If you need more, you need to increase the withdrawal rate.

I have done the calculation for 30 years from the retirement, and the average long-term return from the mutual fund investment is assumed at 10%.

So, from this table, what we can infer that, the Rs. 2 crore retirement corpus reduces down to Rs. 1.91 crore at the end of 30 years from retirement. But still you are not running out of money, and this is feasible when the long-term return that you generate is sufficiently more than the withdrawal amount.