Asset allocation is the distribution of various types of assets throughout an investing portfolio. Equities, fixed-income instruments, and cash are the typical asset classes. Other asset types include derivatives, real estate, gold, cryptocurrency, and so on. However, these asset classes are usually referred to as alternative investment instruments.

The first step in creating an investing portfolio is to develop a list of your financial goals. Why you wish to invest is meaningless without an end purpose. Asset allocation is critical in developing an effective investment portfolio that assures the proper type and amount of risk for you while achieving your financial objectives. The goal of optimal asset allocation is to maximise the rate of return for a given risk. The rate and pattern of such returns vary according to age and risk appetite.

Individual desires to reach a specific degree of return or save for a specific purpose or want are examples of goal determinants. Different objectives influence how an individual invests and takes risks. However, you should allocate assets according to the time to maturity of your objectives. This is due to the fact that the corpus and time period for your short-term objectives are likely to be different from those for your long-term targets. Furthermore, an investment strategy and asset allocation plan that works for a short period of time may not serve for a longer period of time, and vice versa. Also, as you get closer to a financial objective, your capacity to take risks with your portfolio towards that goal diminishes. As a result, it is critical to create distinct portfolios with a solid balance of different financial instruments for your immediate and long-term aims.

This is how you can accomplish it:

Short-term goals:

Because of our collective concentration on retiring in a culture that perceives old age as a gloomy hunger-stricken position, we disregard short-term savings. As a result, our whole attention is on old age, and we tend to overlook the need for near-term savings. Building an ambitious, short-term savings strategy for a specific objective, is a profound tool for getting what you desire without falling into debt. All it requires is some perseverance. Defining short-term financial objectives provides you with the framework and morale uplift you’ll need to attain longer-term goals.

Short term goals often include house improvements, vacations, wedding expenses, credit card debt repayment, and contributions to insurance or to an emergency savings. These goals will have maturity in less than two to three years. For these objectives, you would either expend once or save on a regular schedule to support a certain sort of spending. Because these are short-term goals, the investments available to you are also restricted. These must be low-risk and generate consistent results. The emphasis should be on stability and liquidity. As a result, the best investments would be debt funds, bonds, bank FDs, and so on. The average return on debt instruments is between 6 and 7%.

For instance, suppose you wish to save 15 lakh for house renovation in two years with a 6.5% return. To do this, you are most likely to rely on debt securities, as equities can be unpredictable over a two-year period. If the market turns bearish at the moment of withdrawal, your money may become stranded.

Considering this, you will have to save approximately 60,000 every month for two years, or 13.2 lakh in one single amount. While debt instruments provide lower returns than equity, they also minimize uncertainty and market risk in your portfolio. The emphasis for short-term investing should concentrate on consistent returns. Hence for achieving these goals, strive to make and keep to a budgeting plan.

Long-term goals:

Long-term objectives necessitate a greater share of your assets that can last for years because they serve the larger context of your finances. These are your assets or resources that will assist you meet your wants for the rest of your life. Long-term financial objectives need careful preparation, execution, and patience. These objectives may take years, if not decades, to achieve.

These long-term goals include retirement funds, paying off mortgage loans or purchasing a home, starting a company, investing for a child’s higher education, and so on. These are often your large-picture expenditures. Long-term goals provide us greater freedom in selecting investing solutions. Because the time frame is longer, you can invest in instruments apart from fixed-income securities. To achieve inflation-beating gains, make equities the primary element of your portfolio. You can choose an equity-oriented asset allocation or a mix of equity and debt asset allocation. It is basically determined by your risk appetite in relation to the expected rewards.

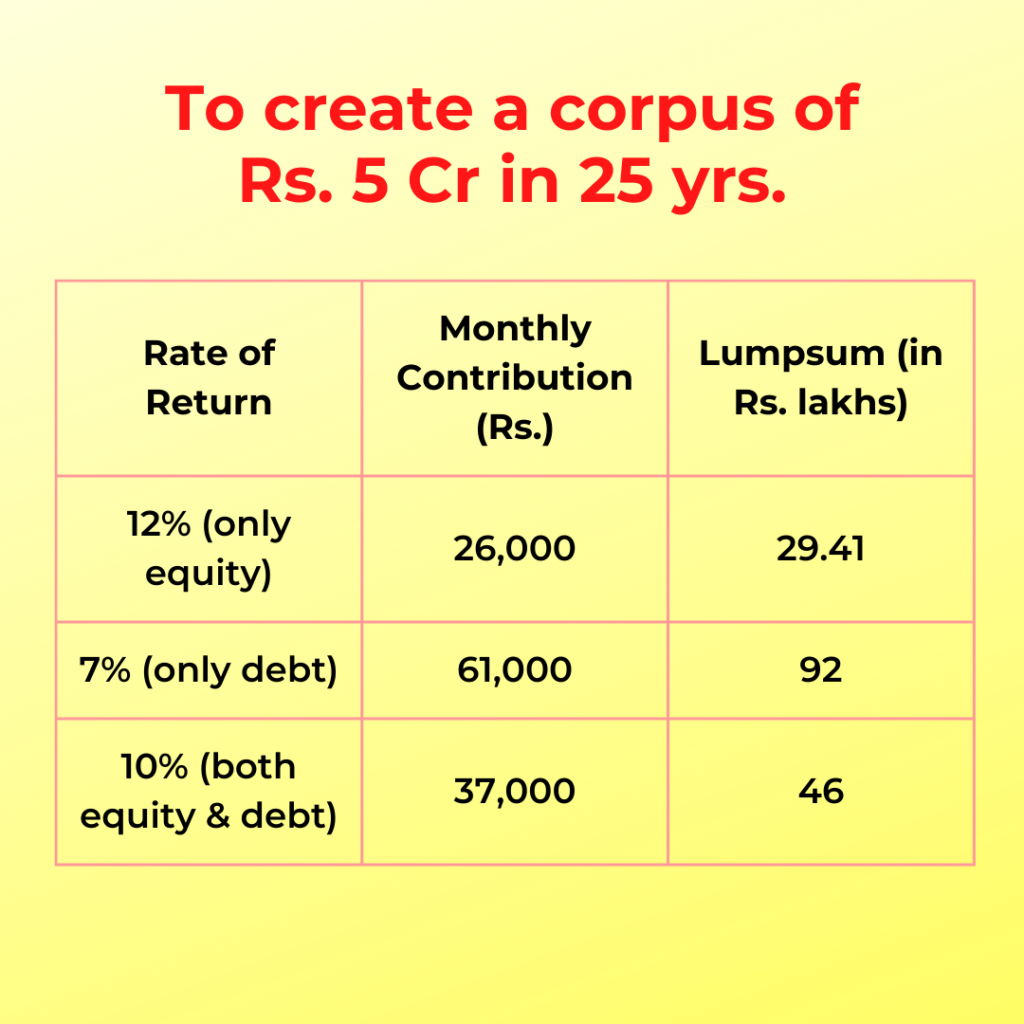

The money generated should allow people to spend their life after retirement without having to go out and look for job. Assume you are 35 years old. Your monthly costs are Rs. 50,000, and you will require Rs. 5 Crore in 25 years to maintain your way of life. The amount you must invest is determined by the projected rate of return. This is also dependent on the mix of equities and debt instruments chosen. In our scenario, adopting an equity-only investment would result in better return but also more risk. This involves only fewer lump sum and monthly contributions. It will be the reverse with debt instruments, which need 2.4x the size of monthly equity contributions and 3.0x the size of lumpsum capital. Please review the table below for further details.

Hence it is critical that your portfolio reflect a sensible approach to asset allocation that includes a mix of both stock and debt securities. This will also help you to optimize your risks and profits.

Conclusion:

To balance your investments, you must have a mix of short- and long-term goals. Work your objectives around your regular spending, prioritizing basics such as food and housing first, followed by emergency and retirement money. The balance of your money could then be allocated to your desires and other savings objectives.

Setting short-term and long-term financial objectives is a critical step toward financial stability. Whether an investor picks a certain asset allocation plan or a mix of approaches is determined by his short and long-term goals, as well as his risk appetite. Thus, first evaluate your short and long-term objectives before allocating your cash to relevant asset classes. The general rule of thumb is to avoid combining short-term and long-term goals in the same allocation.

Long-term and short-term goals necessitate sound decision-making and asset deployment. We should also bear in mind that goal-based asset allocation methodologies that include adjusting to market volatility need a high level of experience and skill in the use of specific instruments for predicting these moves. It is nearly difficult to perfectly time the market, so ensure your asset allocation plan is not overly exposed to unanticipated market swings.