If you have invested in fixed deposits in banks long ago and lost track of them or if your parents or grandparents have made bank deposits on your name long ago and you are ever wondering how to retrieve them, then this article is for you. As per the Reserve Bank of India data, there are still unclaimed deposits of Rs. 35,000 crore in Indian banks, as of February 2023.

To deal with this problem, the RBI initiated a programme called “100 Days, 100 Pays,” in which banks were told to determine and payout the top 100 unclaimed deposits in each district within 100 days. While the campaign ended in August of 2023, there is still plenty to be claimed. In this blog article, we’ll look at what unclaimed deposits are, what transpires with them, and how to get them back.

Table of Contents

What are unclaimed Bank deposits?

Generally, unclaimed deposits are made up of fixed deposits that have not been accessed for over ten years after they matured or amounts in savings or current accounts that have been dormant for at least ten years. These deposits may stay unclaimed for a variety of reasons. People may create accounts, use them seldom, and subsequently lose sight of them, or the account holder’s heirs and successors may be unaware if the account holder dies.

It may also occur if an account holder moves to some other location without alerting the bank. Banks are obligated to disclose to the RBI the total number of such unclaimed deposits and their associated amounts. Unclaimed deposits are subsequently remitted to the Reserve Bank of India’s Depositor Education and Awareness Fund (DEAF). It should be noted that when these unclaimed fixed deposits mature and go unpaid, they accrue interest at the respective bank’s savings rate.

How to track and claim them?

The RBI requires banks to furnish a list of clients with unclaimed deposits and dormant accounts, including the clients’ addresses and identities. After reviewing the information on the internet, you can commence the claim procedure by visiting the bank office with a properly completed claim form, deposit receipts, and KYC papers.

You can experience trouble if the claim relates to an old account from a period before digital banking. In that situation, you should go to your local branch. Following validation, the bank sends the requested amount plus any accumulated interest.

While there is no deadline for submitting claims, banks are required to respond to these requests within 15 days after receiving the necessary supporting documentation, such as the original passbook or term deposit receipt, KYC papers, a recent passport-size photo, and a properly completed and signed KYC.

In the event that the account holder passes away without a registered nominee, the legal heir may make a claim for the funds in accordance with the terms of the Will or by presenting the required paperwork, which may include an inheritance certificate, a notarized death certificate, a duly completed and signed deceased claim settlement form, and, if the bank requests it, an indemnity and a no-objection certificate from each member of the family.

UDGAM Portal comes to your rescue

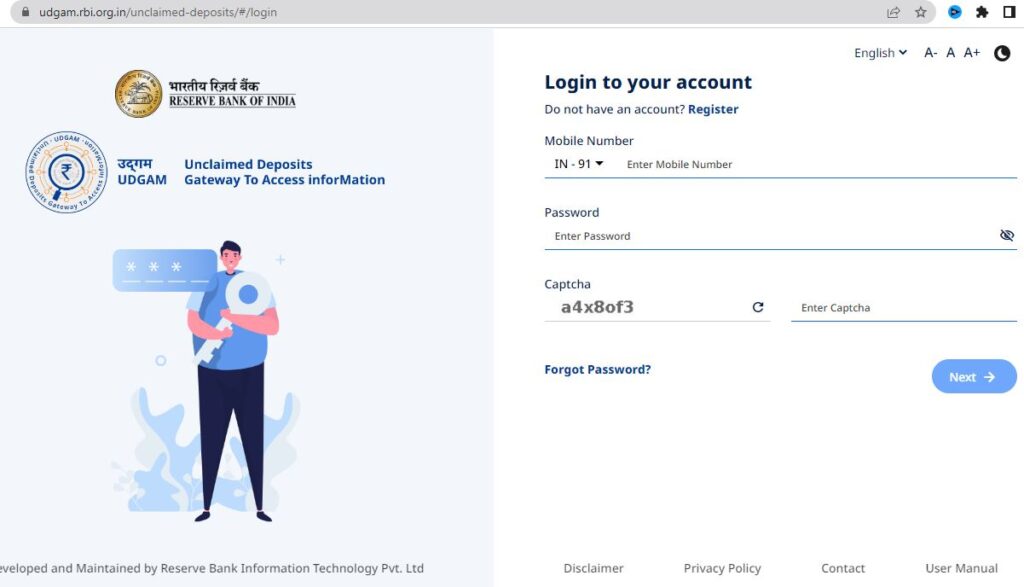

It might be quite time-consuming to visit several banks and branches if we are unsure of which bank or location holds our unclaimed savings. To help with this, the RBI has launched a centralised online platform named “UDGAM” (Unclaimed Deposits – Gateway to Access Information).

This portal consolidates data about unclaimed deposits from numerous banks into a single location. Currently, over 30 banks have joined the platform, including big players like as SBI, ICICI Bank, and HDFC Bank. UDGAM allows users to locate unclaimed deposits and accounts and either collect the deposit sum or restore their accounts at their corresponding banks.

To get started with UDGAM, go to https://udgam.rbi.org.in/unclaimed-deposits/#/register . Register on the site by entering your phone number, complete name, and a new password. Then, use your registered information and an OTP to sign in.

Enter the account holder’s name on the main page, pick the applicable banks, then click the search option. It will show possible deposits.

If you are unclear which bank has your unclaimed deposits, you can pick all banks, all at once. The platform will connect you to the website of the relevant bank, where you can get the claim form and begin the claiming procedure.

How to avoid such unclaimed scenarios

Finally, undertake the following steps to avoid your funds from getting unclaimed:

- Monitor bank records on a regular basis,

- Update contact information when it changes,

- Consider forming a joint FD with a family member or someone you trust rather than keeping it alone, and

- Choose a legal heir who could distribute the deposit sum to beneficiaries in the case of your death.

The list above isn’t exhaustive, but it will assist you in protecting your deposits from being lost due to time or becoming unclaimed.

Unclaimed deposits can be recovered, and the procedure is now more transparent and consolidated via the UDGAM site, making it simpler for people to collect their long-forgotten monies.

Do follow me on Linkedin and Quora for more insightful posts related to personal finance, money management, investments, debt management, etc.

You can also check out my other blogpost on how do joint accounts work in Banks.