The average investor loses money on bank fixed deposits (FDs). A one-year fixed deposit with a nationalized bank in India, assuming 30% interest tax, has provided returns less than consumer inflation in ten of the previous thirteen years. The investor ended up a full percentage point behind inflation over the course of those 13 years. That is, if the annual average inflation in the past 13 years was 7%, then FD returns were only 6%. That means, investing in an FD on January 1st is likely to result in lower real wealth over the course of the next 12 months due to inflation.

Real estate, which is the cornerstone of Indian household savings, does only slightly better. Based on the recent data for the top seven cities in India and the returns adjusted for the current long-term capital gains tax, real estate has only outperformed inflation four times in the previous 13 years. Overall, it performs worse than even FDs.

Now let’s talk about gold. Although gold has had significantly larger price swings, including clear losses in certain years, it has outperformed inflation in nine of the previous 13 years.

The prudent investor would still not have outperformed inflation in six of the previous 13 years if he allocated a third of his assets to each of these three asset types (FD, real estate and gold). He would have still been poorer overall because he would have fallen behind inflation over time.

This analysis’ conclusion is simple to understand. Having some equity exposure in your investment portfolio seems essential if you want to maintain your money’s purchasing power.

One may imagine a scenario in which our prudent investor allocates a fourth of his portfolio to equities, albeit the precise amount of equity allocation would rely on the person’s unique financial situation and risk tolerance. Despite 25% invested in each of the other three asset classes, this portfolio’s post-tax return would have outperformed inflation in 11 of the last 13 years, surpassing the inflation rate by a solid 1.8% annually. The key factor here is the 25% equity allocation in this scenario.

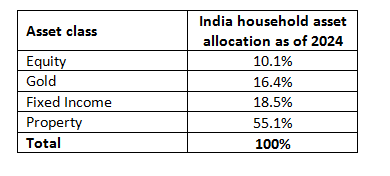

Comparing this recommended allocation to Indian families’ actual portfolios is revealing, which is actually skewed towards real estate investment. Please see the below table for the recent data. This data taken from RBI website and World Gold Council estimates, as the official figures on the overall household balance sheet are difficult to get.

The yearly movement of savings into different asset classes is not shown here; rather, this is a snapshot of total household savings. Financial obligations and liquid assets maintained for transactional reasons, such as cash or the balances of current and savings accounts, are not included in this data table. Since the goal of this exercise is to build a household’s investment portfolio, equity value that is categorized as promoter holdings is not included in this snapshot. The choice of allocation by our Indian household is surprising here given the poor actual returns of the majority of these assets, with the exception of equities. The real return for households over the last 13 years, when annualized, comes around 5.7%, barely keeping pace with inflation. Only in the past few years have households even caught up, mostly because they have been allocating more funds to equity.

Indian households continue to underinvest in equities, despite evidence that this leaves us shortchanged in the long run. Why would Indian households, who are often wise with money, have chosen to spend their resources in this less-than-ideal manner? Digital public infrastructure, creative fintech companies, and India’s push for financial inclusion have all contributed to a recent surge in capital market investment. The public’s knowledge of and utilization of the full range of investing opportunities was restricted in earlier years.

Individuals’ and households’ cognitive evaluation of their savings, and their risk aversion towards equity may be some of the factors of this skewed investment portfolio and less exposure to equity. Also, the typical math of asset distribution does not include property and gold, which are frequently inherited from parents or ancestors.

Although many households do not want to sell these family wealth inheritance, it is crucial to accurately account for them in order to assess the total asset allocation. While one is at it, it is also important to include in frequently disregarded forced-saving tools like insurance policies and/or pension plans.

According to data, about 40% of Indian household’s financial assets are allocated to insurance and pension products. These products have a bias toward fixed-income instruments and have many of the same problems as FDs, which we had discussed earlier. Based on the information provided by pension and insurance companies, as per their companies’ AUM (Assets Under Management) data, Indian households’ total financial asset allocation is 35% in equities and 65% in fixed-income instruments. Hence in these insurance and pension products as well, the investment is skewed towards fixed-income instruments.

Thus the overall data infers that equities make up just 10% of the whole household balance sheet as financial assets make up just over a quarter of all household assets.

Conversely, the asset allocation of financially competent persons differs from that of the general public in that these individuals have a high allocation to equities, particularly when compared to the typical household.

The first crucial step for any investor, if beating inflation over an extended period of time is the ultimate goal of personal finance, is to create a thorough inventory of all household assets, including forced, discretionary, and ancestral (such as properties inherited, gold inherited from parents or ancestors, etc.). It is unlikely to resemble a well-organized chart with each quarter’s assets allocated to fixed-income, gold, equities, and real estate. But if we get somewhere near to that 25% allocation to each asset class, then it will be beneficial to the investors in the long run.

So, in order to tame the silent elephant in the room (which is the inflation), you need to have equity allocation in your investment portfolio. Thought the asset allocation % varies from one person to other, data shows that 25% each in equity, gold, property and fixed-income instruments will beat inflation marginally in the long term. But if you want to convincingly beat the inflation, then the equity percentage in your asset allocation has to be more, and I will leave that to you to figure out what allocation suits you best, as equity seems to be most risky of these 4 asset classes. Though there are still debates going on about the liquidity of real estate or gold when compared to equity, which also investors need to factor in, but that is a different topic of discussion altogether.