Spotting a market bubble isn’t rocket science—it’s often marked by a frenzy of equity interest, with everyone rushing in to make a quick buck. During these times, investors tend to jump into the market at its peak, only to see their capital shrink soon after.

A big giveaway? The rise of sketchy companies jumping on the IPO bandwagon to cash in on the hype. This IPO frenzy in India draws in retail investors, many of whom are persuaded by flashy online influencers or get-rich-quick schemes. It’s not just the big IPOs either—the SME IPO market is buzzing, with people throwing their savings into SME IPOs without fully understanding the risks. It’s a risky game, and one where caution is your best friend.

The IPO frenzy in India hit an unbelievable high when a modest two-wheeler dealer aiming to raise just ₹12 crore ended up with a jaw-dropping ₹4,800 crore worth of bids. This highlights a market dynamic that’s hard to ignore. In 2023-24, the number of IPOs skyrocketed from 125 to an impressive 205, while the first half of 2024-25 saw IPO subscriptions double in India even as global funds raised dipped by 16%.

While these numbers reflect intense market activity, they also carry a sobering warning. A potential market meltdown could have far-reaching consequences—not just economically, but politically, if millions of retail investors find their hard-earned savings wiped out. It’s a reminder that the SME IPO market and broader equity scene demand caution, not just enthusiasm.

Why Is India Experiencing an IPO Frenzy?

India’s IPO market is buzzing like never before, with activity reaching a feverish pace. One of the key reasons behind this craze is the lack of other investment options that can match the returns offered by equity shares, even after factoring in inflation and taxes. This imbalance is affecting the financial landscape in several ways.

For example, bank deposits are growing slower than credit in the banking sector. This forces banks to depend on costlier borrowing options, like certificates of deposit, which push up borrowing costs. On the other hand, retail investors, with few good alternatives, are turning to mutual funds (MFs). These funds, due to limited options in the secondary market, are funnelling money into IPOs, creating inflated valuations in the process.

There are also concerns that some mutual funds and institutional investors might be working with shady companies to artificially boost valuations. This helps promoters make unfair profits, leaving retail investors, often unaware of the risks, to bear the losses.

Retail Investors and IPOs:

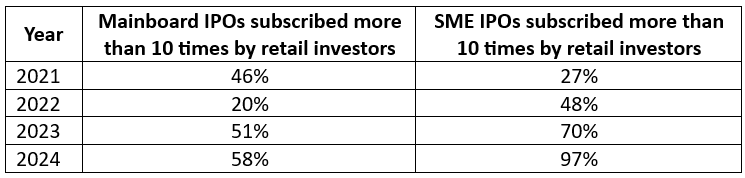

Retail investors are showing great enthusiasm for IPOs, including both Mainboard and SME (small and medium enterprises) offerings. Over the last five years, many IPOs have been oversubscribed by more than ten times in this segment. However, the chances of getting an allocation remain slim, as retail investors receive only 22.8% of the total IPO funds on the Mainboard and 38.3% in SME IPOs.

Interestingly, retail investors’ preference for SME IPOs is growing rapidly. But this trend raises concerns since many people invest their hard-earned money without fully understanding the risks involved. SME IPOs often carry higher risks due to their smaller scale and shorter track records.

The table below shows how the oversubscription trend has grown over the years, especially for SME IPOs.

This growing interest in SME IPOs is both exciting and risky. While it shows confidence in the market, many retail investors may be diving in without fully realizing the potential pitfalls.

SME IPOs: Growth Engine or Bubble Ready to Burst?

India’s Small and Medium Enterprises (SMEs) are storming the stock market, raising billions through IPOs and catching everyone’s attention. While this surge highlights strong investor confidence, it also raises concerns about market manipulation and whether this growth can really last. Is the flood of SME IPOs a solid opportunity, or are we headed for a market bubble?

In recent years, SMEs have been tapping into the IPO market like never before, with issue sizes ranging from ₹5 crore to ₹50 crore. What once started slow has now become a tidal wave. The average SME IPO size has skyrocketed, tripling from ₹10 crore in 2020-21 to ₹36 crore in 2024-25. In just five months of FY 2024-25, 109 SMEs raised a whopping ₹3,983 crore—more than the combined fundraising of FY21, FY22, and FY23. The pace? Almost one IPO every working day! But with FY24 breaking records at ₹6,265 crore across 203 SME IPOs, the big question is: can this growth continue without creating instability in the SME IPO market?

The Risks Behind SME IPO Oversubscription

The SME IPO market’s growth may look impressive, but it’s sparking some serious concerns. Extreme oversubscriptions—sometimes thousands of times over—raise red flags about long-term sustainability. While strong demand might not always mean something shady, the SME segment has seen its fair share of market manipulation.

Smaller companies face more corporate governance challenges due to fewer compliance requirements. Requiring SMEs to match mainboard compliance standards would defeat the purpose of their market—a platform designed to simplify fundraising for smaller firms. To manage risks, only high-risk-tolerant investors are allowed in this space, reflected in the high minimum application size of ₹1 lakh compared to ₹15,000 for mainboard IPOs.

Still, malpractice exists. One common trick involves inflating IPO subscription numbers. Here’s how it works: scammers submit hundreds of duplicate applications, creating a false impression of high demand. Retail investors, misled by the hype, rush in. Later, these duplicate bids are rejected during allotment, but by then, it’s too late for the retail investors who end up facing losses.

Regulatory Changes: Fighting Back Against Fraud

To tackle these issues, regulatory bodies have stepped up. Registrars and transfer agents (RTAs) are now tasked with spotting duplicate bids and ensuring they don’t make it to allotment. Exchanges have tightened controls, filtering duplicate applications at the source to prevent inflated subscription numbers.

For SME IPOs, PAN details are validated during applications to block duplicates instantly. Stock exchanges have also introduced enhanced screening for special categories like employees and existing shareholders.

In a game-changing move, the National Stock Exchange (NSE) now requires SMEs to be cash flow-positive for two out of the last three fiscal years. This rule aims to improve the quality of companies entering the SME IPO market while keeping the platform accessible for small businesses.

Should You Invest in SME IPOs?

Investing in SME IPOs isn’t for the faint-hearted. These offerings carry higher risks compared to mainboard IPOs due to SMEs’ smaller size, shorter track records, and greater market vulnerability. Their stocks are volatile, with limited trading volumes and liquidity challenges that make buying or selling shares tricky.

However, SME IPOs can be a high-risk, high-reward investment for those who do their homework. Recent regulatory changes have improved transparency and boosted confidence in the SME IPO market. But remember: profits are not guaranteed, and careful analysis is a must. If you’re ready to dig deep and understand the risks, SME IPOs might be worth exploring. If not, it’s wise to tread cautiously.

Conclusion: Navigating the SME IPO Wave

The IPO frenzy in India, especially in the SME IPO market, reflects both investor enthusiasm and potential risks. While SME IPOs offer unique opportunities with high-risk, high-reward potential, they demand thorough research and caution. The rise of regulatory measures is improving transparency, but the risks of volatility, liquidity challenges, and possible manipulation remain.

For seasoned investors ready to dive deep, the SME IPO market can be a promising venture. However, for those unprepared for its complexities, it’s wiser to tread carefully. With the right approach, the SME IPO wave can be navigated successfully, but always remember: not every wave leads to shore; some could crash into a bubble.

Check out my other article on whether the capital raised in IPOs nowadays are being infused back into the business or how are they spent.

Follow me on Linkedin for more insights on investments, personal finance, money management, etc., as I write regularly on these topics.