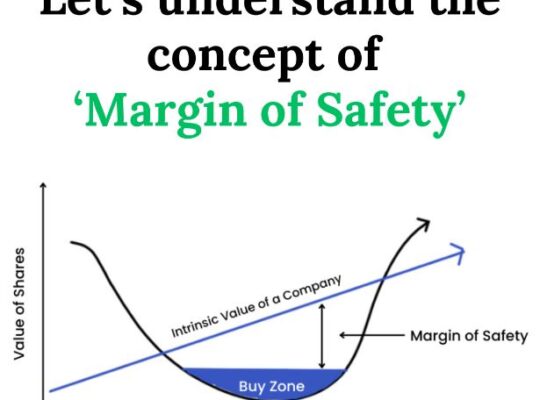

Investment or Speculation: Why Playing it Safe Wins

Investment is the process of setting aside money from your income to invest in an asset that will grow in value over time. On the other hand, investing in high-risk products with the expectation of quick profits leans more toward speculation. Speculation is like taking a risky swing at the final ball in a Twenty20 …