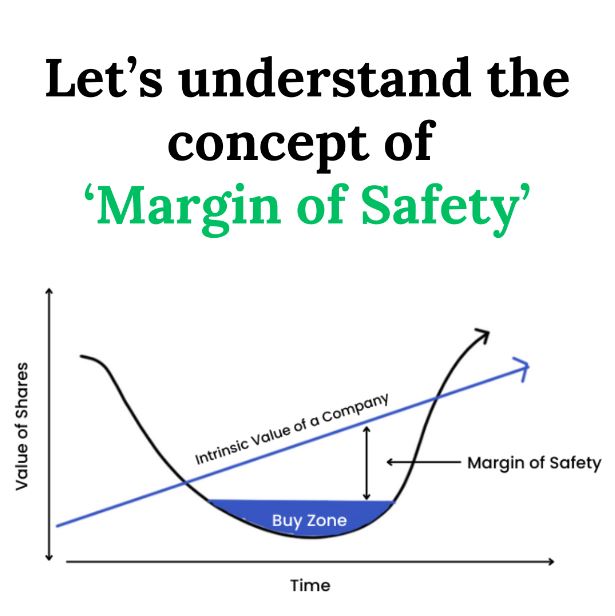

According to Warren Buffett, the three words “margin of safety” are the foundation of investing success.

Global and local geopolitical developments must prompt us to consider if our portfolio was prepared to deal with extended, deep corrections.

A profound unpleasant correction will undoubtedly occur at some time throughout a 30- to 40-year investing journey. Having said that, markets will eventually find a way to break free from years of repeating cycles of boom and bust. The main risk here is that you will be unable to forecast the ‘why’ and ‘when’ of the market correction.

For example, in the beginning of January 2008, when the Sensex was around 21,000, many well-known brokerage companies set a target of 28,000. Even after the bear market began in 2008, the brokers stayed extremely positive in February/March 2008. It was too late to understand reality. The majority of ‘market gurus’ failed to predict the market drop in 2008. Consider the market drop that began in September 2018 in India as a result of liquidity concerns in the NBFC sector. Many people predicted that markets will cool off around December 2018. However, it took more than two years for the Sensex to surpass the top hit in September 2018 on a consistent basis. It goes without saying that it is important to assess the situation.

Now comes the question, how do we assess the situation? The mere three words ‘margin of safety’ indicate the route. In his 1991 shareholder letter, Warren Buffett quotes Benjamin Graham from his book ‘The Intelligent Investor’. He proposes “Margin of Safety” as their tagline in response to the challenge of distilling the meaning of wise investing. He claims that “the failure of investors to pay attention to this simple lesson can cause them catastrophic losses”. In his opinion, those three words are the foundation of investing success.

So, further down in this blog article, we’ll look at what precisely this “margin of safety” is and how you may use it to evaluate the value of your investments. You can go about it in three different ways.

Price vs Value:

We have several examples of stocks that are perfectly valued with no margin of safety. Their share price is often supported by a specific hypothesis, such as the continuation of a strong central government, political relations with China, geopolitical conflicts, government easing of import restrictions, lower taxes, and so on. Furthermore, if a stock is valued at exorbitant levels, which is only due a strong government is an important element to examine as well.

Take the Nifty IT index, which has fallen below levels attained more than two years ago. India’s quality equities, which include a few paint companies and big private-sector banks, have also underperformed in recent years. Such poor performance is due to the fact that investors overpaid at peak levels, rather than the company itself. They were not priced at the margin of safety, but rather on the edge of risk.

So, here’s guideline number one for margin of safety. Check to see if your present stock prices can endure a few setbacks, such as a sales or profits slowdown, margin or earnings contraction, or regulatory action. Even after accounting for these considerations, if the stock’s worth looks to be higher than the present price, you may choose to remain invested. Else, not.

Time value:

When emphasizing value above price, Buffett frequently alludes to a company’s inherent worth also called ‘the intrinsic value’. However, he adds that this is a value that is ‘tough to identify’. Despite our best efforts, we may estimate the value of a stock incorrectly. As a result, establishing a longer window of opportunity contributes to adding another layer of protection.

This is especially true for technology and new age enterprises, which are more challenging to value than conventional businesses. Amazon serves as a fantastic example here. Even if you had purchased the stock at its top during the height of the dotcom bubble in 1999, you would have received 36x returns over the past 24 years. So you genuinely valued it at these astronomical heights, since 36x in 20 years is quite an astounding return.

However, the journey to 36x gains included a 90% fall when the dotcom bubble burst, followed by a rebound to cost price from 2002 to 2007. This was followed by a 50% drawdown (during the global financial crisis in 2008), followed by more than a decade of incredible wealth accumulation.

So, even if you bought at peak levels but got the company and outlook right, margins of safety in terms of time horizon might assist in offsetting any hiccups on the way.

Portfolio Diversification:

Same scenario as above, but instead of purchasing Amazon, if you had bought a Wipro, you would have received subpar (although positive) returns, even if you had purchased it 50% below peak dot com boom levels. This is notwithstanding the fact that its own industry has prospered over the previous two decades, with extended periods being leaders in the area. Unexpected upheavals, such as product commercialization or the introduction of a stronger competitor, eroded its competitive advantage.

As a result, it is critical to supplement value and time span with diversity in order to complete the ‘margin of safety’ process. Having a diverse portfolio also provides the reassurance of being able to average when equities are not performing well. For example, if 20% of your portfolio is invested in one company and it falls 50% (considering all other holdings at same level), your portfolio will be down to 90% of its original value. But if just 5% is in a single stock, and if it falls by 50%, then your portfolio will be down to 97.5% only and not 90%. Highly concentrated holdings should only be attempted by specialized fund managers and not retail investors. However, you have to keep in your mind that your investment case should be compelling for your stocks to bounce back from any crash.

Final thought:

Money may be made in the market in a variety of ways, but using a margin of safety approach that includes a mix of value, time horizon, and diversity allows you to build wealth while sleeping soundly. When properly implemented, election outcomes, geopolitics, and the US recession will not affect you.