In the world of investing, three important aspects stand out: effectiveness, risk, and price. These three components are at the heart of several conversations, and the price has emerged as a distinguishing feature in the services provided of today’s leading wealth management organizations. Furthermore, regulators all over the world clearly see cost efficiency as a vital component of the wider objective of economic stability.

Many people appear to equate cost solely with the fees imposed by financial product producers and middlemen. Some astute investors expand the discussion to include the impact of taxes as well. Seasoned investors would factor inflation into the equation. Most investors spend their whole lives attempting to optimize these expenses, despite the fact that the majority of them are outside their control.

However, there is a hidden cost. Many people have heard of it, and the majority think it exists, yet it is rarely addressed when making personal financial decisions. This is referred to as “the cost of delay”.

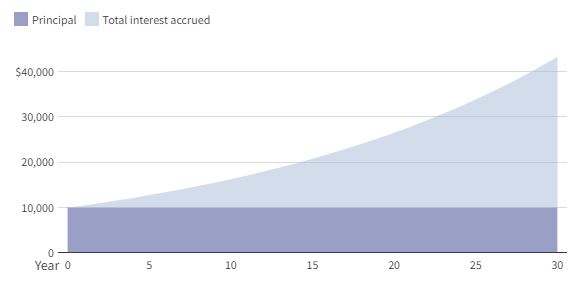

Let’s return to the fundamental math we studied in school and review the part on compound interest. It is just interest on your principal plus interest accrued over the set length of time. Imagine it as a mathematical depiction of the snowball phenomenon. Investment returns are reinvested over time, resulting in further earnings. Compounding increases returns over time by adding interest to interest. This is the ‘power of compounding’, which many financial professionals and scholars consider to be the eighth wonder of the world, and claim it as the key tool to generate wealth.

Consider interpreting the compound interest calculation. You’ll see that variables like the principal amount and interest rate employ standard math operations like multiplication and addition, but time is an exponential variable. This suggests that time, as a variable, has the greatest impact on the total sum. The longer the period of investment, the more powerful compounding grows, demonstrating its capacity to increase wealth over time.

If you invested 10,000, compounded yearly at 5%, it would be worth more than 40,000 after 30 years, with over 30,000 in compound interest.

As a matter of fate, most investors have the most power over the variable time. At each given time, the investible amount is within a specific range. While an investor may want the highest potential rate of return, this is heavily impacted by external circumstances. However, when it comes to time, an investor has more leeway in ensuring that the money is invested for as long as feasible.

Let us try to see an example here to highlight the impact of investment period across different investing scenarios. Most people, particularly those in the salaried class, we will assume that job will provide a steady income for at least 30 years. Among the same demographic, many people postpone investing in long-term goals like as retirement for at least a few years, or until shorter-term demands are met. So, in the table below, we can see what your corpus would be at the end of 30 years if you started investing today vs 10 years later. Even if you triple your investments to make up for the delay, you will still fall far short of the eventual corpus obtained if you started earlier.

| Effect of Early start | Start investing today | Delay investing by 10 years | Delay by 10 years + 3 times compensation |

| Invested period | 30 | 20 | 20 |

| Monthly investments (Rs.) | 20,000 | 20,000 | 60,000 |

| Expected returns (%) p.a. | 12% | 12% | 12% |

| Final corpus (Rs. Crore) | 7.05 | 2.00 | 6.00 |

| Shortfall from early start | – | -72% | -15% |

Cost of delaying your investments:

Investing for a shorter period has a direct and declining influence on the eventual acquired corpus. While everyone’s own financial position is unique, the example above demonstrates that postponing investments, or investing for a shorter period of time, has a direct and declining influence on the total amount accumulated. A 10-year wait might erode nearly three-fourths of the possible ultimate corpus, as shown by the cumulative final corpus of just Rs. 2 crore against Rs. 7 crore if begun ten years earlier. Even raising the monthly investment by three times does not adequately compensate for the lost time, as the ultimate cost would still be 15% lower.

And if you had begun early and increased your monthly contributions by 10% every year, your total corpus at the end of 30 years would have been a whopping Rs. 17.7 crore.

Investors must understand that the route to success in investing is rather simple. The approach is to get started as soon as possible, with as much as possible, and for as long as possible. The greatest strategy to improve the outcome is to increase investments as frequently as feasible and by as much as possible. This structure provides a solid basis. The final outcome is, of course, determined by specifics such as asset allocation, product selection, investing strategy, and so on, but you will definitely end up far better than 99% of your peers.

Compounding is particularly useful for long-term goals like retirement. Individuals might possibly assure a more enjoyable retirement by starting early, investing consistently, and allowing assets to grow over time. The compounding effect allows small sums to grow into considerable retirement assets, guaranteeing financial security in later life. This is based on the fact that compounded returns often surpass inflation, protecting the buying power of invested money during your golden years.

So, some pointers for this magic of compounding to happen are:

- Invest early to benefit from a longer time horizon.

- Consistently add to your investments to maximize growth and compounding.

- Invest dividends, interest, and profits to accelerate growth.

- To maximize compounding, avoid frequent withdrawals and stay invested for a longer length of time.

- Increase your investment amount to maximize both initial capital and future earnings.

- Regularly review and modify your investments to make sure they correspond with your financial objectives.

Conclusion:

Compound interest has a significant impact on savings and investments over time. Compound interest is an important aspect in wealth accumulation since it increases money significantly quicker than simple interest. It also helps to minimize the growing expense of everyday life caused by inflation. For young individuals, compound interest provides an opportunity to capitalize on the time worth of money.

To individuals who understand the concepts of time and money, the phrase “time is money” is more than just a common sense; it is an essential reality.