Bonds are often underrated and misunderstood in the investment world. Many investors see them as boring, safe, and unexciting, offering minimal returns. In fact, bonds are often overlooked, especially when interest rates are low and the stock market is booming. The typical question from stock enthusiasts is: “Why tie up your money in a fixed-interest investment when stocks are paying strong dividends and offering potential capital gains?”

However, bonds can play a crucial role in building a balanced investment portfolio, particularly during times of market volatility. When stocks and property markets get jittery, bonds can provide stability. In uncertain times, an investment offering an 8% annual return with guaranteed capital return suddenly becomes far more appealing. Even if you’re not keen on bonds, keeping an eye on the bond market can give you valuable insights into the health and future of the economy.

What Exactly is a Bond?

At its core, a bond is a fixed-income investment. When you invest in bonds, you’re essentially lending money to an entity, such as a government or corporation, for a set period at a fixed or variable interest rate (known as the coupon). These bonds can be traded in the secondary market, and their price and yield move in opposite directions. When a bond’s price falls, its yield rises, and vice versa.

During a bull market, as people flock to stocks, bond prices typically drop, pushing yields up. Conversely, when bond yields rise, stock investments may seem less attractive unless a company’s earnings grow faster than those bond yields. Bonds are often considered a “risk-free” investment, as investors are guaranteed their principal and interest, provided the borrower (government or corporation) stays solvent.

That said, bonds issued by risky countries or companies (like those in Venezuela or Argentina) are not considered risk-free. But bonds from stable, developed nations, like India, are typically seen as low-risk.

How Are Bonds Traded?

Bonds can be bought and sold in the secondary market after their initial issuance. Some bonds are traded on public exchanges, but most are sold over-the-counter (OTC) through brokers and dealers. A bond’s price and yield determine its value in the secondary market.

How is the Annual Interest Rate on a Bond Calculated?

To calculate the annual interest (coupon), multiply the amount invested by the number of days invested, divide by 365, and then multiply by the interest rate. The yield at which the bond trades is calculated using the term, coupon, and the bond’s current market price.

Why Should Bonds Be Part of Your Investment Portfolio?

Bonds act as a counterbalance in your portfolio. When stock prices drop, bond prices usually rise, leading to lower bond yields. For corporate bonds, the extra yield above government bonds reflects the risk of not getting your money back at maturity, as companies are more likely to default than governments.

Investors in Indian government bonds can expect both principal and coupon payments to be returned at maturity with a high level of certainty.

How Do Bonds Help Your Portfolio Adapt to Economic Changes?

Bonds are especially valuable during uncertain times or when a recession seems likely. As investors move to the safety of bonds, their prices rise and yields fall. Historically, bond yields have soared during market crashes or economic slowdowns. For example, in 1987, before the stock market crash, bond yields were over 15%. When the economy slows down and market sentiment weakens, bond prices often rise as more investors seek safer, low-risk options.

Can Bonds Help You Take Advantage of Economic Cycles?

Yes! Investors concerned about inflation can look into inflation-indexed bonds, where the inflation rate is added to the bond’s price quarterly. These bonds act as a hedge against rising prices, ensuring that your real returns are preserved during inflationary periods.

On the other hand, fixed-rate bonds offer a constant coupon rate for their duration. Meanwhile, floating-rate bonds pay an interest margin over a floating benchmark, like a 90-day Treasury bill rate. If inflation and interest rates are on the rise, floating-rate bonds or inflation-indexed bonds are better suited to protect your investment.

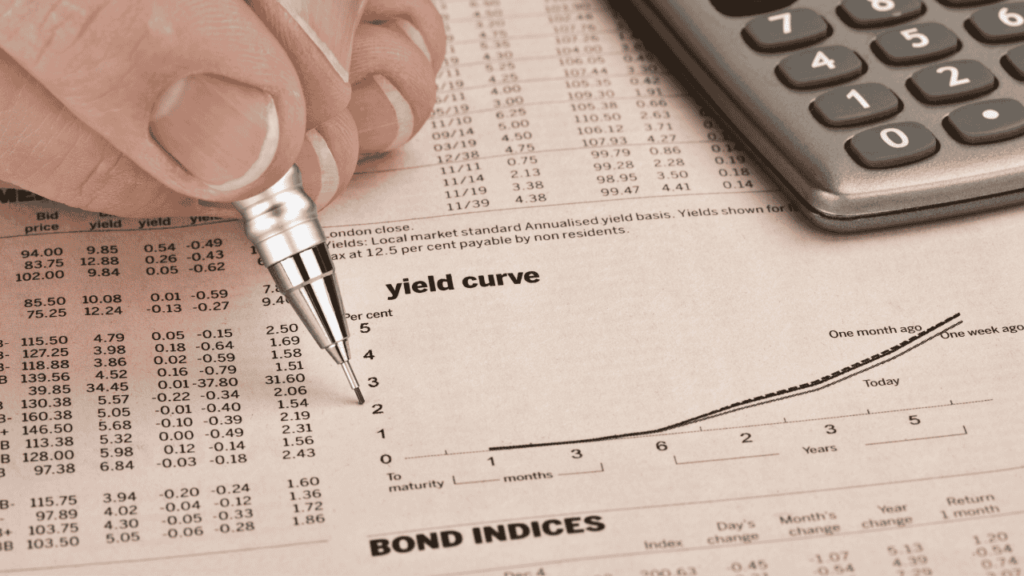

What Does it Mean When Yield Curves Invert?

Typically, the longer you lend your money, the higher the interest rate should be. But occasionally, the yield on short-term bonds (like two-year bonds) can be higher than that on long-term bonds (like ten-year bonds). This anomaly, known as an inverted yield curve, can indicate that the market expects interest rates to rise, or that inflation and economic activity will be weak in the future.

Economists often view an inverted yield curve as a potential sign of a coming recession, though it’s not a guarantee. Historically, inverted yield curves have preceded significant recessions, such as the 2008 Global Financial Crisis and the COVID-19-induced recession in 2020.

The History of Bonds vs. Stocks in India: Returns & Risk

Historically, Indian stocks have shown higher volatility in the short term but have delivered better long-term returns compared to bonds. For example, the Sensex index has delivered a 13% annual return over the past 30 years. In contrast, the average yield on Indian government bonds has been around 7-8% during the same period.

Conclusion: Why Bonds Should Be Part of Your Balanced Portfolio

A well-rounded investment portfolio should include a mix of stocks, property, gold, bonds, and cash, with cash acting as a safety net in times of market turmoil. Bonds are typically a long-term investment that generates regular cash flow and offers an attractive return over the life of the bond.

In summary, bonds might not have the same excitement as stocks, but they can provide much-needed stability, especially during uncertain times, making them a key component of a diversified investment strategy.

You can also check out my other article on how you can diversify your investment portfolio with US Bonds.

Do follow me on Linkedin for more such insights on investments, personal finance, money management, etc.