Flipping is the practice of an investor buying an item to hold for a little time and then selling it for a quick profit. Short-term investors sometimes buy stocks with the intention of selling them quickly in order to make significant profits. In the investing market, this activity is frequently referred to as “flipping.”

The practice of utilizing a company’s listing to quickly buy and sell shares is known as “IPO flipping.” Many investors view initial public offerings (IPOs) as an opportunity to profit quickly if the share price spikes up within a few days after listing. They then attempt to sell the stock at a higher price in an attempt to capitalize on the rising demand for it.

When an IPO is made available to investors, a number of them purchase shares in lots and hold them for a short amount of time. As soon as the shares are listed, these investors sell them on secondary markets. The assumption that IPOs may yield a larger return if sold on the day of issue with listing gains is the reason why investors choose to flip their stocks rather than retain them for an extended period of time. Furthermore, they have the notion that there is no assurance that the share prices will continue to rise in the future. Hence their short-sighted view of the stock.

It is difficult for a retail investor to keep onto the funds they have invested. You cannot profit from the continued growth of the companies you invest in if you do not purchase and retain stock assets for an extended period of time. Approximately 54% of the IPO’s value was sold in the first week after listing, according to a recent SEBI survey on IPOs. Those HNIs with substantial wealth were in the front lines. Within a week, they liquidated two-thirds of the shares. According to the SEBI report, ‘IPO flipping’ occurs more frequently in shares of firms that climb significantly. The study further identifies that Gujarat accounts for over 40% of all retail investors who flip their shares after IPO listing. That is a lot greater than the 13.5% of investors in Maharashtra, which is the second-highest IPO flipping state.

Due to this short-term thinking, over 68% of retail investors sold their shares when the share price increased by 20% on average upon debut in the secondary market. However, even when the returns were negative, up to 28% of individual investors liquidated their shares. These can be those who took out loans to participate in the IPO. The thought of deliberately selling at a loss is difficult to fully comprehend. The SEBI study also discovered that during the first week of listing, mutual funds—which have a larger holding capacity—were the net purchasers of these newly listed companies, thus creating value for the mutual fund investors.

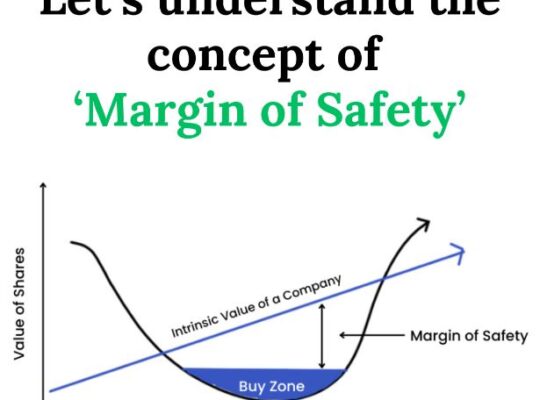

As I have reiterated earlier in my blog-posts, short-term investing in equity assets is never considered as investing; it is called trading or even gambling to some extent. Everything appears to be low-risk and high-return investment during a bull market. But there aren’t any free lunches in the stock market investments. Financial markets fluctuate in up-and-down cycles. The long-term trajectory of equities markets is determined by corporate earnings. If businesses continuously make profits in spite of temporary selloff tendencies, share prices would rise gradually. However, there is always a strong probability that shares will fall if there is an aggressive increase in share prices and earnings fall short of expectations.

Companies choose to go public for a number of reasons. You think you can get a bargain in the company that is offering the market a comparatively low price in the public offer during a bull market. But sellers of shares to exit a company in an IPO are there for some reason. These businesses would have raised capital from their founders, business organizations, anchor investors, and private equity investors.

When a company makes a selling offer in an IPO, it is often a secondary share sale in which no money is invested in the company. The funds generated in this IPO generally goes towards the sellers of these shares. No new shares are being issued. In a typical environment, a business typically goes for IPO as it sees potential in itself for substantial room for expansion.

A recent warning from SEBI also addressed the IPOs of small and medium-sized businesses. Bids from companies in the SME sector are far more extensive than anticipated. The private market or the fresh issue markets are most likely where you are searching for value during a bull market. On the other hand, IPO pricing is determined by a method that takes into account current market trends in companies that are comparable. The firm that wants to list shares often offers them at a lower price than the industry average. Before making an investment, an investor must, however, be aware of the risks.

When investing in an IPO, it is impossible to predict if it will be in great demand. It’s easy for your market behaviour prediction to go incorrect. Flipping is therefore an extremely risky tactic. It may take years to profitably pay out your investment if the IPO is listed at a low price.

You must familiarize yourself with the company’s core operations, their fundamentals, etc., before considering the company for your investment. You should not apply for shares in an IPO if you lack the necessary information or you do not understand the draft red herring prospectus. Also, while investing in initial public offerings, don’t mindlessly follow social media influencers or other marketing tricks. In order to generate demand in the IPO market, companies typically employ sophisticated marketing techniques to represent a superficial value for their stocks. It may take years before you can profitably cash out your investment if you invested in an IPO because of the marketing hype and it doesn’t perform well subsequently after listing.

Conclusion:

Any investment should have its possibilities discussed with an expert. But that expert person should be a SEBI-registered independent financial advisor. If you do not have any financial advisor to advise you, then it is better to stand on the side-line and let go off the IPOs, similar to an overcast day in a test match, where the batsmen let go off the swinging balls that are outside off-stump.

IPO Flipping is a technique used by investors to quickly benefit by earning quick money from extremely risky investment. Before you think of flipping an IPO, you should conduct adequate market research because such profits from IPO flipping are not guaranteed. To prevent losing money on your investment, it is usually a good idea to select newly listed companies only if they have strong fundamentals.