Let’s start by defining what “frugality” is.

Frugality is the attribute of being modest, thrifty, cautious, or economical in how one uses finite resources, such as food, time, and money, and how one avoids wasting anything by going overboard. It involves the prudent management of financial resources in particular.

Frugality is characterised in an economic sense as the propensity to purchase things and services sparingly and to creatively employ ones already held resources to accomplish longer-term objectives.

Living frugally, however, does not imply living cheaply. Knowing the difference between being frugal and being cheap is essential to live thriftily yet comfortably. Paying less for worse quality is cheap. But being frugal is paying less for the same or better quality.

The goal of frugality is to live a cost-effective lifestyle without sacrificing comfort. This calls for understanding both where and how to minimise expenses.

Now let us see why Frugality is an important aspect in Personal Finance.

Firstly – People do compare:

Most individuals aren’t happy with their existing level of wealth. The common question people ask themselves is that whether they are doing better than they were earlier? Is the current wealth more than yesterday’s? Almost everyone claims that they would want twice or three times as much wealth as they currently possess to be content with, but when they reach that target, they will strive to achieve further more wealth. People are comparing themselves to others, which is the cause of this. People gauge their own achievement by contrasting what they have with what others have.

The basic message here appears to be that making comparisons to anyone’s scenario is going to be problematic. Maybe doing so causes you to want more, which will drive you to work more and harder for money on a never-ending greedy treadmill.

FIRE movement:

The early retirement trend has gained popularity in recent years. This trend is popularly known as “Financial Independence Retire Early,” (FIRE). Individuals have realised that they are not required to labour at occupations they despise for forty years. They can attain financial independence at the age of forty or in their mid-thirties if they are able to widen the gap between their income and expenses and sustain a high savings rate.

Increasing income is undoubtedly a crucial component of the FIRE equation, but it’s not the only one. The basic rule of personal finance is that your wealth is equal to your income minus your expenditures. Thus, in reality, your spending has a significant impact on how quickly you may accumulate money and/or meet your financial objectives.

So, it’s imperative that you fight the impulse to compare yourself to others if you wish to save money.

One of the biggest strengths of the FIRE movement is this. As such, members of the FIRE movement communities have chosen to actively avoid playing the comparison game. Financial freedom is typically portrayed as leading a life without consumerism rather than a life of social comparison.

One of the FIRE community’s most famous quotes is, “If you strive for obtaining it all, what you’ve got is never sufficient”.

Being frugal is appreciating the virtue of making the most out of every moment of your life and of whatever you have access to. Recently, a lot of individuals have embraced and endorsed FIRE and written extensively on the benefits of being frugal.

It is apparent that not everyone interested in early retirement desires to be frugal. Some people aspire to financial security in order to lead expensive lives. They desire luxurious homes and expensive vehicles. They aspire to be wealthier than their friends and family. But they won’t be content with this.

Benefits of being Frugal:

Whether you think about consumption or not, being frugal provides fairly considerable financial advantages. The less you consume, the less money you need to make a living, the fewer stuff you have to carry around with you, and the earlier you can retire.

Let us look into this concept of frugality with a mathematical example.

Let’s assume you have a job and earn Rs. 60,000 a month from it. You will have no money left over at the end of the month if your monthly costs total Rs. 60,000. If something goes wrong, like getting sick, losing your work, etc., you’ll be forced to reduce your spending because your living costs are equal to your income.

On the other hand, if your monthly spending is limited to Rs. 25,000, you have a reserve. You’ll be better prepared to handle the crisis if you experience a disease or accident that keeps you from working for six months. Instead of having to find a job that pays Rs. 60,000 per month if you lose your work, you simply need to find one that earns Rs. 25,000. Spending less opens up more easy employment possibilities.

The less you consume the less money you need to make to maintain your present standard of living. Also, you can retire early if you spend less.

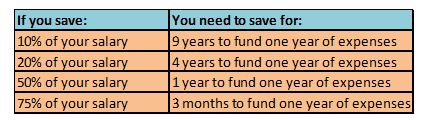

You may retire at 40 instead of 60 if you maintain an aggressive saving rate of 50% or even 70% in your 20s and 30s. This offers you forty years rather than twenty to do whatever you choose with your life (assuming average life expectancy of 80 years).

The power of increasing savings, and hence the power of frugality, is illustrated in the table below. It illustrates few scenarios of how much of your profit margin you must set aside to cover your full year cost:

Spending less makes it simpler to accomplish all financial objectives. Frugality purchases discipline, and discipline purchases freedom. Spending less has benefits beyond merely improving your financial situation. The time and flexibility that would have been needed to earn that money are now yours to keep.

Conclusion:

As Dave Ramsey quotes – “If you will live like no one else, later you can live like no one else.” By denying yourself some options now, you can avoid living a life of deprivation in the future.

Being frugal means making cost-conscious decisions about spending and recognizing effective ways to save money. It’s critical to consider your desired lifestyle as well as your financial capabilities and determine whether being frugal fits into either. Lastly, do not attempt to practice thriftiness in all areas at once. It’s not intended for being frugal to be a burden. Enjoy your economical way of living while paying less.