“All that glitters is not gold,” as the old adage goes. Historically, investors have maintained a percentage of their capital in gold. This protects against the losses that equities might sustain during a downturn in the economy. This has been, and continues to be successful.

However, a number of affluent individuals, organizations, celebrities, and businesses have recently added Bitcoin or other cryptocurrencies to their portfolios. Cryptocurrencies like Bitcoin and Ethereum are proving to be an intriguing substitute to gold, both as a hedge and as a source of fast rewards.

Gold is the favorite asset among elder investors, although cryptocurrency is more attractive to new ones. But how will this virtual currency stack up against gold, as gold is the world’s longest running asset? Let’s take a closer analysis of the debate ‘Cryptocurrency versus Gold’ in this article.

Gold:

Gold has a lengthy history that precedes human civilisation. The first recorded use of gold for ornamentation goes back to 4000 BC. There’s a possibility that it was being used for something else (maybe bartering) before then.

Gold could not be created. A firm may issue new shares, and a central bank can create new money, but gold is not one of them. It has to be extracted first from earth and treated. This is why, irrespective of demand, gold supplies stays markedly lower.

Gold has long been utilized as both treasure storage and a means of trade. It also has inherent value as jewellery and as a useful material in the creation of numerous things, including electronics. Gold is extremely durable and a superb electrical conductor.

Gold has played an important role in world politics and economy throughout the years. Until 1971, most worldwide currencies were tied to the price of gold (In 1971, US ended the international convertibility of US dollars to Gold – this meant foreign governments could no longer exchange their dollars for gold).

When investors are scared, gold starts to trade upward; when they are more optimistic, gold tends to trade down. This is a perfect illustration of gold offering portfolio insurance when it is most required, and it demonstrates why investors seeking to control risk are inclined to purchase gold than crypto in their holdings.

Having said that, gold’s basics have not strengthened significantly in recent years. Gold, according to experts, is momentarily higher during recessions since some investors use it as a source of wealth and as a market hedge for safety in investments. Aside from that, there is no long-term potential creation to support gold as a profitable investment asset category. The point is that the price and value of gold are heavily influenced by investor mood, which at times goes missing in this asset class. When we return to a world of low and steady inflation, gold’s upward price prospects may likewise be quite limited.

Cryptocurrency:

Cryptocurrency is intended to function as a decentralised currency and as a rapid payment option. It is thought to be an improvement over traditional bank transactions, which can take several days.

Bitcoin decentralised technology debuted in 2009, ushering in a new age of banking and investment. Originally, these virtual currencies were only appealing to a small group of individuals who know in and out about it.

Bitcoin, the first cryptocurrency, was made publicly available in 2009. This was made possible by an unidentified inventor going by the name Satoshi Nakamoto. Since then, it has grown to be the world’s most famous cryptocurrency. Huge Crypto mining facilities and pools grew in popularity, as did cryptocurrency exchanges. Bitcoin has also spurred the development of alternative cryptocurrencies like as Ethereum, Tether, Solana, and others.

Cryptocurrency is a decentralized currency. This implies that it is not regulated by a reserve bank or a government. It also implies that officials will not grab your coins or suspend your accounts. It is feasible since there is no link to government services.

The fundamental argument in favour of crypto is that it has the potential of becoming a widely utilised means of exchange and a store of wealth. Because the quantity of cryptocurrency is restricted, its worth should climb over time as it gets more widely embraced. However, while the eventual upside of cryptocurrency is potentially huge, it is also quite unknown.

Crypto has still not been broadly accepted as a form of currency, and its significant price fluctuation shows it is not yet a good store of wealth. Regulatory agencies are also closely monitoring its progress and may try to limit its usage if it threatens their authority over national financial networks.

The price of cryptocurrency is also volatile due to concerns about its future worth and privacy vulnerabilities. Cryptocurrency price volatility may be a burden. The below chart shows how volatile their prices can go.

Key similarity between these two asset classes:

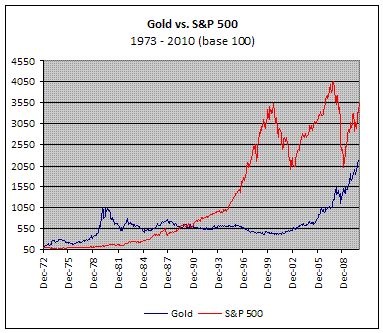

Unlike most of the other investments, cryptocurrency and gold have little underlying revenues, profits, or free cash flow. As a result, their pricing and value are very unpredictable and heavily dependent on market mood and capital inflows.

Let us take a closer look at the above-discussed point – “Gold and Crypto have really no underpinning cashflows.”

When you invest in stocks, such as in shares of Reliance Industries Ltd (RIL), you are purchasing a small portion of a real firm that manufactures and sells goods and services. As a shareholder, you have a right to a fair portion of this firm’s profits, free cash flow, and dividend. Similarly, if you buy RIL bonds, you will be paid to your part of the coupon and principal distributions.

These underpinning cashflows improve stockholder rewards immediately. Stock markets and investor confidence can be volatile, but the fundamental cashflows received by investors raise the asset’s pricing to sustainable levels. However, whether you engage in gold or cryptocurrency, you are only eligible to the item that you purchased. These two produce no cashflows, dividends, or interest payments, and they do not expand.

This absence of underpinning cashflows significantly raises unpredictability, and is a big minus for both Cryptocurrency and Gold. The fundamental investment tenet is that “an investment is worth the net present worth of its future projected cashflows”. So, if potential cashflows are ‘nil’, the investment is essentially worthless (at least on paper!). However, neither Cryptocurrency nor gold is going to drop to zero. The main difference is that the absence of supporting cashflows implies that both assets might incur severe losses.

Let us get into the real debate – ‘Gold Vs Crypto’:

Gold is a genuine physical commodity with obvious industrial and commercial uses, and it is utilised in a variety of items such as jewellery and electronics. The term cryptocurrency refers to a virtual currency that may be used to do transactions and other financial activities.

Although the pricing and valuations of both commodities are heavily dependent on market emotions, gold has more strong foundations than Crypto. Gold’s price and worth are largely decided by its practical usage. However, this does not imply that cryptocurrency is useless to investors. It is built on Blockchain technology, which is extremely hard to hack, and the virtual currency has undoubtedly contributed to the creation of more value than gold (since the inception of bitcoin in 2009).

The price of gold is highly improbable to go to zero, or close to zero, for an extended period of time. This is because unusually low gold prices should stimulate retail, commercial, and corporate demands, eventually leading to a price rebound for gold.

On the other hand, because crypto is a digital money with no physical existence in the actual world, its value might go to zero or near to zero. However, given current market attitude, I do not believe this is probable, but a major decline in crypto values is possible.

Gold, on the other hand, hasn’t ever traded at such low levels. Gold has not once traded below $200 an ounce in the last 100 years (as last 100 years is the maximum period of gold price bookkeeping), and has only gone below $300 an ounce in very unusual circumstances.

The standard deviation of cryptocurrency is 4.34, which measures how much it may go over its average cost in either way. Gold, on the other hand, has a standard deviation just above one. If you would like a more reliable asset, gold is certainly the best option.

Both cryptocurrency and gold are appealing investment alternatives, but to distinct kinds of investors. Gold is more attractive amongst older investors for a myriad of purposes, including its longer history and performance record of success, comparably good basics, and demonstrated efficacy as a hedge against inflation, among others. Conversely, younger investors are much more interested in crypto, and there is a strong, substantial association between an individual’s age and their enthusiasm in crypto. Younger investors believe that cryptocurrency will increase in value in the future.

Money influx into cryptocurrency would accelerate as younger investors enter their peak income years, resulting in greater prices for crypto. It is quite improbable that gold will see comparable influx of capital into it. These young investors are not particularly interested in gold as a substitute asset.

This is how young investors think. But how do governments and banking authorities throughout the world think? Gold is often used as a backup resource by central banks all over the world, which distinguishes it from Crypto. Countries keep gold reserves as a safe harbour, with France, the United States, and Germany each keeping nearly 80% of their overall deposits in gold. This use of Gold as a back-up asset theoretically puts a floor on the value of gold.

Australia has the greatest proven gold deposit, accounting for 20% of world resource. Gold storage is firmly rooted in local culture in several regions of the world. For example, gold is a crucial element of Indian ceremonies and marriages, which is why Indian families have a $1.5 trillion gold stockpile.

On the other side, governments throughout the world are only now starting to embrace cryptocurrency. El Salvador declared bitcoin legal currency in 2021, and other countries such as Brazil and Mexico are contemplating in doing the same. Even Elon Musk, the world’s richest person (at the time of writing this article), is a supporter of cryptocurrencies, as his firm accepts cryptocurrency transactions for Tesla car buys.

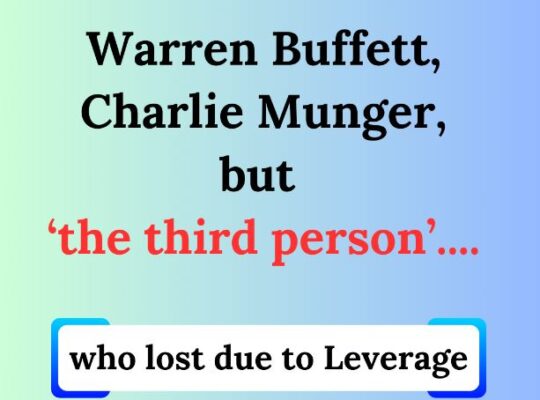

Satoshi Nakamoto, the crypto network’s enigmatic inventor, owns the most bitcoin. Nakamoto owns 1 million bitcoin, or around 4.7% of the entire quantity. Approximately 1% is held by public businesses. In reality, no country now controls more than 35% of the world’s mining output.

Conclusion:

Given that gold and cryptocurrency account for just around 3% of the overall world’s economic asset pool, we must not be shocked to see both expand in the future. Of all, only time will tell how gold and cryptocurrency will do in the coming years.

Although cryptocurrency has more dramatic price increase, it also has significantly more instability. Most importantly, it still does not have a proven record as a safe haven. On the other hand, gold has a lengthy track record of being less erratic than cryptocurrency.

Gold ranks higher than cryptocurrency in terms of legality, openness, security and trust. Most significantly, gold is the fundamental currency of global central banks.

Hence I think it’s far too early to claim that cryptocurrency will replace gold !

[…] In this instance, I would strongly insist you to read through another article written by me here, wherein we see which assets is a better investment, gold or crypto? (Nevertheless, there is no […]